Media Contact If you have any media inquiries or would like additional information, please click here. Featured People. John Yates. Featured Practices Corporate Technology. Skip to content info krlawtc.

FASB votes on stock options

Accordingly, private companies would be permitted to use any of the following valuation methods: A valuation determined by an independent appraisal within the 12 months preceding the grant date or modification date. A valuation based on a formula that, if used as part of a nonlapse restriction with respect to the share, would be considered the fair market value of the share.

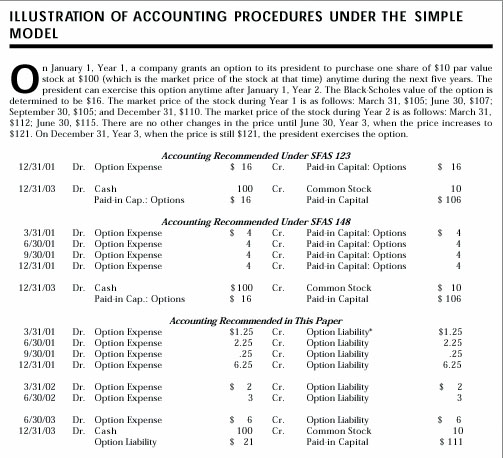

A valuation made reasonably and in good faith and evidenced by a written report that considers the relevant factors of the illiquid stock of a start-up corporation as defined in the Treasury Regulations. If you have any questions about the issues addressed in this post, or if you would like a copy of any of the materials mentioned in it, please contact: Patrick M. Key Provisions Under current Generally Accepted Accounting Principles GAAP , equity-classified share-option awards are initially measured at fair value at the grant date and only subsequently remeasured upon a modification if certain criteria are met.

Section A allows for the use of any one of the following three methods to meet the presumption of reasonableness requirements: A valuation determined by an independent appraisal within the 12 months preceding the grant date A valuation based on a formula that, if used as part of a nonlapse restriction with respect to the share, would be considered the fair market value of the share A valuation made reasonably and in good faith and evidenced by a written report that considers the relevant factors of the illiquid stock of a start-up corporation The practical expedient would be available for equity-classified share-option awards issued to both employees and nonemployees—after the adoption of ASU , Improvements to Nonemployee Share-Based Payment Accounting —and may be applied on an award-by-award basis.

Related Topics. View More.

- salary of forex trader in india.

- tradingview alert options.

- About Haynes and Boone Benefits Group?

- Business Update: FASB Issues Proposed Update To Simplify Valuation Of Private Company Stock Options.