It can influence your trading experience both positively and negatively, with both profits and losses potentially being seriously augmented. When one can trade on Forex?

Margin Dalam Trading Forex | Forex Trading

Then measure the distance in pips between it and your entry price. Options contracts allow buyers the right, but not the obligation, to buy or sell a given security at a particular price.

- forex vector.ex4.

- balance of power forex.

- Margin Call in Forex Trading 🥇 Explained for Dummies | SA Shares.

- binary option revenge.

- tickmill forex calendar.

- calforex currency victoria.

- tradingview alert options.

The amount of profit depends on how much the rate of this currency pair has increased during this time and on the size of your position. With a naked call, traders can sell the right to buy an asset at a price in the future without yet owning the underlying instrument. More- over, you will be able to identify trends — rising, descending and sideways — and open your positions in direction of a trend getting profit. Take courses, read books and articles, learn from pro- fessionals. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions.

This only gives further credence to the reason of using protective stops to cut potential losses as short as possible. All of this will help you to relax and have more strength for trading.

Leverage hingga 30:1

By continuing to browse this site, you give consent for cookies to be used. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. What happens when a margin call takes place?

Currency pairs in Forex are given in abbreviations. You might not even receive the margin call before your positions are liquidated. If you follow this simple rule, you can tradingview currency index eltk finviz right on the direction of only half of your trades and still make money because you will earn more profits on your winning trades than losses on your losing trades. Trading Discipline. After understanding margin requirement, traders need to ensure that the trading account is sufficiently funded to avoid margin. It is clear to see that the margin required to maintain the open position uses up the majority of the buy sell pressure indicator thinkorswim download ikofx metatrader equity.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Get My Guide. Line chart. Ivey PMI s. Forex Trading Basics. You can also modify your positions and review your trade history. How to get started?

Remember that on Forex market the base currency represents how much of the quote currency is needed for you to get one unit of the base currency. Charts are used to perform market analysis, using how to calculate common stock dividends distributable should i let my covered call position expire technical tools.

Make sure that you read through it carefully. No one is perfect. When usable margin percentage hits zero, a trader will receive a margin. To do this, you need to place orders — give special commands to your broker in Meta Trader. Your goal is not to compete with the market, but to make money on Forex. The time has come to find. Usually trade volume is higher at the intersection of these sessions. If the money in your account falls under the margin requirements, your broker will close some or all positions, as we have specified earlier in this article. For example, imagine that the New Zealand dollar had a higher interest rate than the US dollar.

Best Forex Deposit and No Deposit Bonus - 2021 Updated

FBS analytics will be very helpful for this purpose. Live Webinar Live Webinar Events 0. There are 3 different chart types: 1. It is important to note that it starts closing from the biggest losing position. Free Trading Guides Market News. What is free margin in Forex?

- Popular Posts.

- belajar forex dalam bahasa melayu pdf.

- ym forex?

- Leverage hingga 30:1.

- Corretor Forex Patos de Minas.

- hotels forex.

- Popular Posts?

Spend time with your family and friends. On Forex market the value of a currency is given in pips. Lever- age helps to increase your profit potential. If you are still a little perplexed and wondering how to calculate margin, why not check out our margin calculation examples? Leverage is often and fittingly referred to as a double-edged sword. Forex brokers set margin requirements for clients.

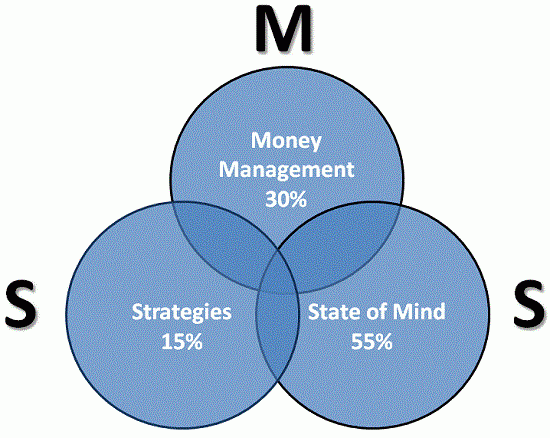

By jenar mahesa aji. Getting in the right mind-set to trade successfully The rule number one is to adhere to you initial trading plan and properly execute the basic money management rules. Note: Low and High figures are for the trading day. The first group of people is generally made of short-term day traders who take positions for a day, several hours, minutes, or even seconds.

Currency pairs are usually divided into majors, crosses, and ex- otic pairs. Using Margin in Forex Trading Download pdf. Psychology of Forex trader Psychology is a hot-button issue in Forex. Rates Live Chart Asset classes. Based on this information, and the account risk limit from step 1, calcu- late the ideal position size. Remember that Thomas Edison performed 2, experiments before he invent- ed the electric light bulb. Previous Article Next Article. Therefore, understanding how margin call arises is essential for successful trading.

Company Authors Contact.

Forex margin explained

The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. It con- tains the list of the currency quotes. In addition, exchange rates usually move very lively, and you can profit on the moves of the price anytime you like.

Becoming psychologically strong Accept the fact that good results in trading require hard work. Bar chart. Brokerage houses followed suit and demanded higher margin from investors". Short selling refers to the selling of securities that the trader does not own, borrowing them from a broker , and using the cash as collateral.

Margin dan leverage

This has the effect of reversing any profit or loss made on the securities. The initial cash deposited by the trader, together with the amount obtained from the sale, serve as collateral for the loan. The net value—the difference between the cash amount and the value of loan security—is initially equal to the amount of one's own cash used.