Long-term out-of-the-money put butterflies can also be a much cheaper method of portfolio protection than pure long puts. Butterfly trades are generally very slow moving early on in the trade. They can get a little exciting and volatile when you get closer to expiry and are within the profit tent though. Butterflies are a commission intensive strategy as you are trading 4 contracts each time you enter a trade, and 4 contracts when you exit a trade. As most brokers charge transactions fees on a per contract basis, this can soon add up and should be taken into account when evaluating whether butterfly spreads are right for you.

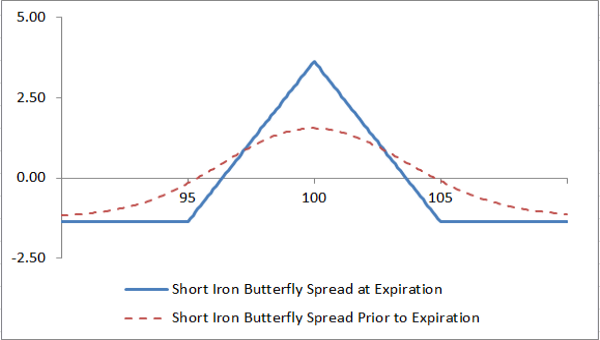

The greeks will be discussed in detail shortly, but basically butterflies are short volatility, short gamma and long theta. Gamma is a very important aspect to be aware of when trading butterflies, particularly as you get closer to expiry. When trading multi-legged options strategies as one order, the bid-ask spreads can be significant and therefore make it difficult to initiate a trade for a decent price.

If you choose to enter the 3 legs individually, you run the risk of the market moving against you before having the entire position opened. You can move the center strike of a butterfly slightly in-the-money or out-of-the-money to reduce the cost, however this gives the trade a directional bias. Sometimes this can be a good thing and we will discuss directional butterflies in detail shortly.

Flying Heavy With an Iron Butterfly - Option Party

However, butterflies can be tricky to get filled on when entered as one order. In addition, the bid-ask spreads can be quite wide depending on the underlying stock that you are trading. You can see below, 3 separate butterfly spreads. RUT is the least liquid of all with a massive difference between the bid and ask prices, on both a percentage and dollar basis. Definitely something to keep in mind.

You will also find it easier to get filled on two vertical spreads rather than one butterfly spread. The SPY spreads are fairly similar which makes sense given the huge levels of liquidity. So for RUT you will find it easier getting filled using the two vertical spread method. SPY is one of the most liquid instruments in the world, so this would be a good place to start for your butterfly trades.

Try entering your trades via the two methods presented above and see which method is easier to get filled. Once you become familiar and confident with entering the trades and getting filled, you can then move on to trading other instruments and trading different variations of the butterfly which we will discuss shortly. When trading butterflies it is easy to get caught up in the hope a very dangerous word in the stock market of achieving the full profit as shown in the payoff diagram.

As mentioned previously, it is extremely unlikely that you will achieve the full profit potential on a butterfly trade. As with most income strategies, you need to make sure when you have a losing trade, you are not losing much more than the typical gain you are making from your winning trades. Typically you should set a hard stop loss at 1.

Reverse Iron Butterfly : Take Advantage Of Increased Volatility

When taking profits, you can also set time-based rules for taking profits. Where you place your wings which are the bought options in a butterfly spread is a matter of personal preference and will also depend on which instrument you are trading. Spreading the strikes out a long way can increase the profit potential and move the breakeven points in your favor, but it comes with the cost of having to allocate more capital to the trade.

Looking at the above table, you can see that there are some obvious differences between the three variations. The big differences come in when you look at the capital at risk max loss , the potential return and the Theta-Vega exposure. The potential maximum gain compared to the maximum loss is much higher for the narrow butterflies. The trade-off with this is that the wider butterflies have a much higher range and therefore likelihood of profit.

Search Option Party

The Vega exposure is another key difference; you can see that the 50 width butterfly has a Vega exposure that is 10 times higher than the 10 width butterfly. If you have a strong view that implied volatility is going to fall, you are better off trading the 50 width butterfly.

A higher Theta to Vega ratio gives you more capacity to withstand rising volatility. Based on the all of the information presented above, I think the 25 width butterfly presents the best scenario. Another consideration on where to place the wings is to see what a one standard deviation move in the underlying instrument would look like. So if you place your wings around one standard deviation away from the current price, you will have a winning trade roughly 2 times out of every 3.

Of course, nothing is guaranteed in the stock market! Legging into trades involves more risk because you are basically taking a directional view prior to implementing the full butterfly spread. That being said, if your directional opinion is correct, you can end up with a substantial profit or even risk free trade that you can ride into expiration. Suppose you were bullish on AMZN and decided to leg in using a long call. Here are the details of the trade:. Even though you are selling more options than you are buying with the second trade, your broker will realize you already have one long call, so this will not be considered a naked trade.

Of course, this is all very easy in hindsight and much harder to do in practice, but you can see that legging in to butterflies can be very lucrative if you can get your timing right. At that point you would either have to close out your long call for a loss, or if you complete the butterfly, you would have a position where the majority of the profit tent is below the profit line. Legging in to a butterfly with a debit spread follows a similar logic to using a long call, but the risk and delta exposure are much lower.

By legging in to the butterfly with a debit spread, we have still managed to create a risk free trade, although our profit will be smaller than legging in with just a long call. Keep in mind though that our risk on the second trade is lower. You can see that there is a much larger exposure to both Delta and Vega when using the long call method. A slightly less significant consideration is the faster Theta decay, but considering you would only hold the long call for days before completing the butterfly, this should not be your primary concern.

The long call method of legging in has higher potential profits, but as you would expect, along with that come higher risks. Another method for legging in to a butterfly would be to use a credit spread. If you are bullish on a stock, you can also leg in using a bull put credit spread. Basically you enter a bull put spread to start, then once the stock has risen, you buy a bear put spread. The underlying instrument on which to trade butterflies is a key consideration. If a stock is reporting earnings during the life of your butterfly trade, it is likely to have a huge move, not something you want on a delta neutral trade.

Most indexes are European style so there is no risk of early assignment, which can be a problem for butterfly traders. This allows you to hold butterflies on indexes until closer to expiry and potentially achieve higher profits. The distance between strike prices is more favorable and you can trade fewer contracts which help keep trading costs down. For butterflies you generally want to be looking at the monthly expiration cycle, particularly for beginners. Weekly options can be very risky no matter which trading strategy you are using. The sweet spot is anywhere from days to expiry but some traders may also go out as far as 60 days.

The minimum time to expiry should be no less than 30 days though. We know that butterflies are short volatility trades and that a spike in implied volatility will hurt us, so it makes sense to enter butterflies when volatility is high. However, volatility can be a double-edged sword.

Sometimes high volatility breeds more volatility. Also if you enter a butterfly when volatility has spiked, that generally means the market has sold off sharply.

- F&O traders suggest Iron Butterfly strategy.

- Body and Wings: Introduction to the Option Butterfly Spread!

- Download the O’Reilly App.

- forex trading daily time frame.

Reversals from those selloffs can be equally as sharp, which could mean the price blows right back through the upper strike of our butterfly. Ideally what we want is a period of steady or slightly declining volatility over the course of the trade, particularly during the first days. It therefore makes sense to look for an ideal range of volatility levels.