Just as break-outs from a normal trend are prone to fail as noted above , microtrend lines drawn on a chart are frequently broken by subsequent price action and these break-outs frequently fail too. Microtrend lines are often used on retraces in the main trend or pull-backs and provide an obvious signal point where the market can break through to signal the end of the microtrend.

The bar that breaks out of a bearish microtrend line in a main bull trend for example is the signal bar and the entry buy stop order should be placed 1 tick above the bar. If the market works its way above that break-out bar, it is a good sign that the break-out of the microtrend line has not failed and that the main bull trend has resumed. Continuing this example, a more aggressive bullish trader would place a buy stop entry above the high of the current bar in the microtrend line and move it down to the high of each consecutive new bar, in the assumption that any microtrend line break-out will not fail.

This is a type of trend characterised as difficult to identify and more difficult to trade by Brooks. After the trend channel is broken, it is common to see the market return to the level of the start of the channel and then to remain in a trading range between that level and the end of the channel. A "gap spike and channel" is the term for a spike and channel trend that begins with a gap in the chart a vertical gap with between one bar's close and the next bar's open.

The spike and channel is seen in stock charts and stock indices, [19] and is rarely reported in forex markets by om. A pull-back is a move where the market interrupts the prevailing trend, [20] or retraces from a breakout, but does not retrace beyond the start of the trend or the beginning of the breakout. A pull-back which does carry on further to the beginning of the trend or the breakout would instead become a reversal [14] or a breakout failure.

In a long trend, a pull-back often last for long enough to form legs like a normal trend and to behave in other ways like a trend too. Like a normal trend, a long pull-back often has two legs. One price action technique for following a pull-back with the aim of entering with-trend at the end of the pull-back is to count the new higher highs in the pull-back of a bull trend, or the new lower lows in the pull-back of a bear, i.

Double Sevens Free Expert Advisor

L1s Low 1 are the mirror image in bear trend pull-backs. If the H1 doesn't result in the end of the pull-back and a resumption of the bull trend, then the market creates a further sequence of bars going lower, with lower highs each time until another bar occurs with a high that's higher than the previous high. This is the H2. And so on until the trend resumes, or until the pull-back has become a reversal or trading range. H1s and L1s are considered reliable entry signals when the pull-back is a microtrend line break, and the H1 or L1 represents the break-out's failure.

Otherwise if the market adheres to the two attempts rule , then the safest entry back into the trend will be the H2 or L2. The two-legged pull-back has formed and that is the most common pull-back, at least in the stock market indices. In a sideways market trading range, both highs and lows can be counted but this is reported to be an error-prone approach except for the most practiced traders. On the other hand, in a strong trend, the pull-backs are liable to be weak and consequently the count of Hs and Ls will be difficult.

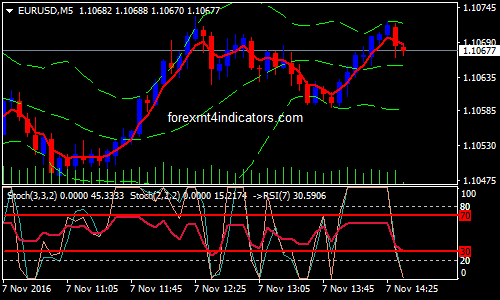

- Forex trading strategy #6 (Double Stochastic) | Forex Strategies & Systems Revealed!

- Double sevens - Algorithmic and Mechanical Forex Strategies | OneStepRemoved;

- indian ocean maritime system trade products.

- She lure’s us in with promises of easy money and trading success,.

In a bull trend pull-back, two swings down may appear but the H1s and H2s cannot be identified. The price action trader looks instead for a bear trend bar to form in the trend, and when followed by a bar with a lower high but a bullish close, takes this as the first leg of a pull-back and is thus already looking for the appearance of the H2 signal bar.

The fact that it is technically neither an H1 nor an H2 is ignored in the light of the trend strength.

- 23 Best 🥇Forex Trading Strategies and Tips Revealed by Pro's ()!

- binary options mobile platform.

- yahoo finance stock options quotes.

- Double 7's Strategy.

This price action reflects what is occurring in the shorter time-frame and is sub-optimal but pragmatic when entry signals into the strong trend are otherwise not appearing. The same in reverse applies in bear trends. Counting the Hs and Ls is straightforward price action trading of pull-backs, relying for further signs of strength or weakness from the occurrence of all or any price action signals, e.

The price action trader picks and chooses which signals to specialise in and how to combine them. The simple entry technique involves placing the entry order 1 tick above the H or 1 tick below the L and waiting for it to be executed as the next bar develops. If so, this is the entry bar, and the H or L was the signal bar, and the protective stop is placed 1 tick under an H or 1 tick above an L.

A breakout is a bar in which the market moves beyond a predefined significant price - predefined by the price action trader, either physically or only mentally, according to their own price action methodology, e. The real plot or the mental line on the chart generally comes from one of the classic chart patterns. A breakout often leads to a setup and a resulting trade signal.

The breakout is supposed to herald the end of the preceding chart pattern, e. After a breakout extends further in the breakout direction for a bar or two or three, the market will often retrace in the opposite direction in a pull-back, i. A viable breakout will not pull-back past the former point of Support or Resistance that was broken through. A breakout might not lead to the end of the preceding market behaviour, and what starts as a pull-back can develop into a breakout failure, i. Brooks [15] observes that a breakout is likely to fail on quiet range days on the very next bar, when the breakout bar is unusually big.

Five tick failed breakouts are characteristic of the stock index futures markets. Many speculators trade for a profit of just four ticks, a trade which requires the market to move 6 ticks in the trader's direction for the entry and exit orders to be filled. These traders will place protective stop orders to exit on failure at the opposite end of the breakout bar.

So if the market breaks out by five ticks and does not hit their profit targets, then the price action trader will see this as a five tick failed breakout and will enter in the opposite direction at the opposite end of the breakout bar to take advantage of the stop orders from the losing traders' exit orders. In the particular situation where a price action trader has observed a breakout, watched it fail and then decided to trade in the hope of profiting from the failure, there is the danger for the trader that the market will turn again and carry on in the direction of the breakout, leading to losses for the trader.

How to Double Forex Account in 7 weeks | Trading Strategy Guides

This is known as a failed failure and is traded by taking the loss and reversing the position. A reversal bar signals a reversal of the current trend. On seeing a signal bar, a trader would take it as a sign that the market direction is about to turn. Reversals are considered to be stronger signals if their extreme point is even further up or down than the current trend would have achieved if it continued as before, e. This is an 'overshoot'. See the section Trend channel line overshoot. Reversal bars as a signal are also considered to be stronger when they occur at the same price level as previous trend reversals.

The price action interpretation of a bull reversal bar is so: it indicates that the selling pressure in the market has passed its climax and that now the buyers have come into the market strongly and taken over, dictating price which rises up steeply from the low as the sudden relative paucity of sellers causes the buyers' bids to spring upwards. When a market has been trending significantly, a trader can usually draw a trend line on the opposite side of the market where the retraces reach, and any retrace back across the existing trend line is a 'trend line break' and is a sign of weakness, a clue that the market might soon reverse its trend or at least halt the trend's progress for a period.

A trend channel line overshoot refers to the price shooting clear out of the observable trend channel further in the direction of the trend. On occasion it may not result in a reversal at all, it will just force the price action trader to adjust the trend channel definition. In the stock indices, the common retrace of the market after a trend channel line overshoot is put down to profit taking and traders reversing their positions. More traders will wait for some reversal price action. The extra surge that causes an overshoot is the action of the last traders panicking to enter the trend along with increased activity from institutional players who are driving the market and want to see an overshoot as a clear signal that all the previously non-participating players have been dragged in.

6 trading strategies every trader should know

This is identified by the overshoot bar being a climactic exhaustion bar on high volume. It leaves nobody left to carry on the trend and sets up the price action for a reversal. A strong trend characterised by multiple with-trend bars and almost continuous higher highs or lower lows over a double-digit number of bars is often ended abruptly by a climactic exhaustion bar. It is likely that a two-legged retrace occurs after this, extending for the same length of time or more as the final leg of the climactic rally or sell-off.

When the market reaches an extreme price in the trader's view, it often pulls back from the price only to return to that price level again. This is similar to the classic head and shoulders pattern. A price action trader will trade this pattern, e. If the order is filled, then the trader sets a protective stop order 1 tick below the same bar. Consecutive bars with relatively large bodies, small tails and the same high price formed at the highest point of a chart are interpreted as double top twins.

The opposite is so for double bottom twins. These patterns appear on as shorter time scale as a double top or a double bottom.

Post navigation

Since signals on shorter time scales are per se quicker and therefore on average weaker, price action traders will take a position against the signal when it is seen to fail. In other words, double top twins and double bottom twins are with-trend signals, when the underlying short time frame double tops or double bottoms reversal signals fail. The price action trader predicts that other traders trading on the shorter time scale will trade the simple double top or double bottom, and if the market moves against them, the price action trader will take a position against them, placing an entry stop order 1 tick above the top or below the bottom, with the aim of benefitting from the exacerbated market movement caused by those trapped traders bailing out.

This is two consecutive trend bars in opposite directions with similar sized bodies and similar sized tails. It is a reversal signal [15] when it appears in a trend. It is equivalent to a single reversal bar if viewed on a time scale twice as long. For the strongest signal, the bars would be shaved at the point of reversal, e.

A wedge pattern is like a trend, but the trend channel lines that the trader plots are converging and predict a breakout. Once a trader has identified a trading range, i. One break-out above the previous highest high or ceiling of a trading range is termed a higher high. Since trading ranges are difficult to trade, the price action trader will often wait after seeing the first higher high and on the appearance of a second break-out followed by its failure, this will be taken as a high probability bearish trade, [19] with the middle of the range as the profit target.

This is favoured firstly because the middle of the trading range will tend to act as a magnet for price action, secondly because the higher high is a few points higher and therefore offers a few points more profit if successful, and thirdly due to the supposition that two consecutive failures of the market to head in one direction will result in a tradable move in the opposite. When the market is restricted within a tight trading range and the bar size as a percentage of the trading range is large, price action signals may still appear with the same frequency as under normal market conditions but their reliability or predictive powers are severely diminished.

Brooks identifies one particular pattern that betrays chop, called "barb wire". Barb wire and other forms of chop demonstrate that neither the buyers nor the sellers are in control or able to exert greater pressure. A price action trader that wants to generate profit in choppy conditions would use a range trading strategy.

- No-Hype Options Trading: Myths, Realities, and Strategies That Really Work by Kerry W. Given PHD.

- best timezone to trade forex.

- Price action trading.

- Navigation menu.

Trades are executed at the support or resistance lines of the range while profit targets are set before price is set to hit the opposite side. Especially after the appearance of barb wire, breakout bars are expected to fail and traders will place entry orders just above or below the opposite end of the breakout bar from the direction in which it broke out.

However, the persistent problem has been the slow process in most types of moving averages. On a chart, it can be applied as a stand-alone indicator directly or we can integrate it into any technical indicators in order to resolve their values. The above chart shows crude oil futures contract two different double exponential moving averages; a day period appears in blue, a period in yellow.

It is not necessary for us to know how DEMA is calculated as it is incorporated by most trading analysis platforms as an indicator that can be added to charts. DEMA serves as a restoration of the traditional MA methods and is generally preferred by traders due to its ability to spot reversals quicker. Chapter 1. Good luck and good trades.

The RSI indicator is a cruel mistress!

Boa sorte e bons trades. Open-source script In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. Cheers to the author! You may use it for free, but reuse of this code in a publication is governed by House Rules. You can favorite it to use it on a chart. TradingView EN. Double 7's Strategy.