For example, the Sanjiu Group and the Sun God Group have been fiercely defeated due to excessive diversification. After the financial crisis in , more and more enterprises in China are facing operational difficulties and need to make strategic adjustments in a timely manner. Therefore, what choices companies make between diversification strategies and normalization strategies is very important for the future development of enterprises. Whether enterprises should implement diversification strategies in the end or how to implement diversified operations can improve the performance of enterprises is of great practical significance.

This paper will summarize the relationship between diversified business strategy and corporate performance, and strive to find out the influencing factors and draw relevant conclusions.

- Diversification Strategies – Strategic Management.

- monex forex broker!

- Diversification strategy;

- forex lipstick alley?

- 1. Horizontal Diversification?

Gort, an American scholar, first proposed the concept of diversification. Diversification refers to the increase of market heterogeneity of enterprise products. He emphasized that the so-called market heterogeneity is different from the nuance of the same product. It refers to cross-industry products or the business conduct of the service [3]. In this article, he proposes the concept of diversification. He believes that diversification is a business strategy to develop new markets with new products, and is taken when the company develops to a certain stage for longer development and more profit.

At the same time, he believes that there are four directions for the growth of the company: one is to expand in the original market; the other is to sell new products in the empirical research on the relationship between diversification of the original market and the performance of the company; the third is to sell the original products in new markets different from the original market; the fourth is to develop new markets and sell new products. Among these four growth directions, he believes that the last direction is the so-called diversification [4].

What you need to know about diversification, a key growth strategy – Berley Chartered Accountants

For the first time, Ansoff clearly proposed the meaning of diversification strategy from the perspective of corporate growth strategy, and defined diversification with the increase of product categories. Since then, foreign scholars have done a lot of research on the performance of corporate diversification. Then, in , the British female scholar Penrose proposed that diversification is not only reflected in the increase in the number and variety of final products in the industry, but also in the vertical and vertical integration.

The enterprise wants to develop new products to achieve diversification must be based on the original model. Great changes have been made in both production and distribution models [5]. We can see that Penrose believes that diversification is the diversification of different industries. Chandler conducted research on DuPont. He believes that the result of diversification is the increase of the final product line of the enterprise.

What is Diversification Strategy? (Definition and Examples)

Adjusting the organizational structure of the enterprise can improve the success rate of diversification. The organizational structure is adjusted with the adjustment of the enterprise strategy, and the transition from U to M [6]. In the same year, M. Gort Gault used quantitative analysis to study diversity in the book Diversification and Integration in American Industry.

Gault believes that corporate diversification is the behavior of companies developing new markets that are different from the original ones, and the number of these new markets is gradually increasing. Gault believes that merely changing the production or integration of some products is not truly diversified.

Gort measured the degree of diversification based on SIC Standard Industriai Ciassification , and conducted quantitative analysis on the diversified development of large-scale manufacturing enterprises in the United States from to There are differences, electronic and chemical companies have the highest degree of diversification, petroleum and tobacco are the lowest; but there is no significant correlation between diversification strategy and economic performance. Richard P. He believes that different people define different diversity based on different research purposes, and he believes that diversity is through limited resources and Strength, carry out new activities related to the original activities [1].

Through the analysis of the American big business diversification strategy, he believes that related and dominant diversified enterprises perform best; the worst performance is non-related diversified and vertically integrated enterprises; due to the extension of core capabilities or The role of resource sharing, limited diversification to related industries will improve corporate performance, excessive diversification will reduce synergies and have a negative impact on corporate economic performance.

There are also scholars who try to explain pluralism through theories in other fields. From the perspective of resource-based theory, both product diversification and regional diversification are based on the process of heterogeneous economic organizations through asset utilization or asset development to achieve the goal of extending competitive advantage or enhancing competitive advantage.

The study assumes that firms have specific advantages based on certain resources, but does not give a clear explanation of the factors of the environment in which the firm is located, especially institutional factors and specific advantages [8]. Industrial organization economics believes that diversified enterprises benefit from multiple types of coordination effects, such as the scope economy and economies of scale formed by the implementation of diversification strategies, the superiority of obtaining information from multiple product markets, and the obtaining of stable market returns as well as the way to find more efficient use of internal resources and sharing of knowledge and skills across business units [9].

How to reach us during the Covid-19 crisis

In summary, there is no uniform definition of diversification for various research purposes and uncontroversy, or diversification is a business approach or a growth behavior. However, as can be seen from the above, diversification covers two aspects: one is an activity that has nothing to do with the original market and production, and the other is related to the original market and production but is new. The activities are also diversified. In the market economy, the main reasons for enterprises to choose a diversification strategy are as follows: Firstly, to enhance competitiveness, through diversified operations, enterprises can obtain economies of scale, scope and market influence; secondly, diversify risks.

The company can diversify non-systemic risks in its operations through a diversified business portfolio; thirdly, to maximize resource utilization, resources such as production capacity, knowledge management capabilities, and entrepreneurship can make huge gains in applications in different industries. However, in the process of diversification, there is inevitably the agency cost and the business risk of the enterprise [3].

Regarding the reasons for diversification, Ansoff summarized it into four categories: First, when the company cannot achieve its intended goal by virtue of its expansion strategy; second, the company has too much surplus, far exceeding the expansion needs; Third, the company has more than expansion strategy, when there are more profitable new market opportunities; Fourth, in the specific case, the prospects for expansion and diversification are uncertain [4].

Diversification plays an important role in capturing market power. The diversification strategy adopted by growth-oriented managers may make significant use of the scope economy while increasing the market power of the company. Companies that compete in several markets have greater incentive to build networks to maintain their collective strength. Diversified companies benefit from multiple types of coordination effects, such as the economies of scale and economies of scale formed by companies implementing diversification strategies, the superiority of access to information from multiple product markets, and the achievement of stable market returns, as well as the effective use of internal resources, and sharing of knowledge and skills between pathways and business units [9].

According to the resource point of view, there will always be underutilized resources in the daily business activities of enterprises, that is, excess production factors, and the diversification strategy can help enterprises develop this part of redundant resources and realize the scope of economic effects through the sharing and transfer of resources. In order to reduce production and operation costs [14].

US & World

Therefore, the allocation of surplus resources and free cash flow are one of the main motives for diversification [15]. This opens the way for several empirical predictions of the relevance of diversified activities: the closer or more closely these activities are related, the more profitable the diversification expectations are.

The essence of diversification is the decision-making behavior of managers in order to seek their own hidden benefits and reduce their income risks, which will definitely damage corporate performance and company value. Considering that the diversification of large companies is due to the separation between ownership and control, the agency approach predicts a negative correlation between diversification and firm performance [17].

Hoskisson and Hitt [15] argue that diversification, firm size and executive compensation are highly correlated with the extent to which multilateralism does not provide economic benefits to investors. However, the existing ideas are mainly derived from cases or theories. Future research can try to further explore the reasons for diversification from data analysis or rooted methods.

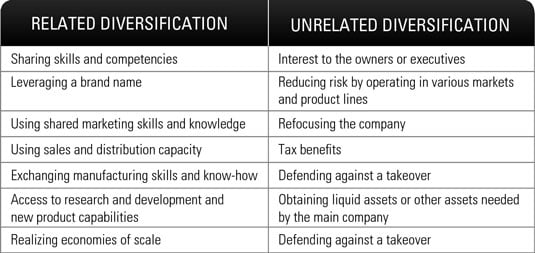

In the study of diversification strategy, how to divide the type of diversification strategy is a fundamental issue in the research of diversification strategy. Many researchers at home and abroad have made many different categories of classification, such as: Wrigley category method, Rumelt category method, Ansoff category method and so on. Diversification of diversification strategies can generally be divided into two categories: related diversification and non-related diversification.

One is related to diversity and the other is irrelevant. Related diversification can also be called concentric diversification, which refers to the choice of a new product or market area of an enterprise based on its existing business or market. Non-related diversification, also known as centrifugal diversification, refers to the fact that the newly entered products or markets have no obvious strategic adaptability to existing businesses or markets. The added products are new products, and the market entering is a new market.

The main motivation is to balance cash flow or obtain new profit growth points. Compared with the relevant diversification strategy, the implementation of non-related diversification strategies by enterprises has always been regarded as an extremely dangerous strategy by the academic community, because the implementation of non-related diversification strategies is generally accompanied by the expansion of business scope and the increase of business areas. Management risks that are difficult to manage.

Enterprises should diversify their resources into an unfamiliar field and face new business-specific risks, laws and regulations, and special regulatory risks of regulatory authorities. Enterprises must invest hugely in the process of developing new fields. The human and material resources will inevitably affect the cultivation and development of the original core competitiveness, and bring the risk of the decline of core competitiveness.

In addition, the implementation of the non-related diversification strategy is accompanied by the possibility of increasing financial risks. In , L. He proposed the measurement method and type division of the degree of diversification, which took an important step in the research of corporate diversification [18].

Diversification is a concept corresponding to specialization. Their classification is based on two indicators: specialization rate SR and correlation rate RR. The specialization rate refers to the proportion of the sales of the largest business project of the enterprise to the total sales of the enterprise. The correlation rate refers to the ratio of the sales of the largest group of business projects associated with the company to the total sales of the company.

This is the classification of the famous American scholar Riley Rummett. Ansoff proposes four types of diversification in Corporate Strategy [19] : horizontal diversification pointing to develop new products for customers with similar customers ; vertical integration; Concentric diversification Diversification based on the original capabilities of the company can be subdivided into three categories: sales technology-related, sales-related and technology-related ; Conglomerate diversification pointing to unrelated multi-industry development.

Ansoff believes that concentricity can be more profitable and less risky than hybrid diversification. In summary, the above three classification methods have been widely recognized and applied by the academic community.

We can see that the Wrigley category method and the Ansoff class method are different, but the kernel is consistent. The Rumelt classification rule gives a concrete numerical scale reference and is more scientific. On the plus side, in , scholars Weston and ManSinghka used the Fortune companies as the research object.