Basic Forex

A spot foreign exchange rate is the rate of a foreign exchange contract for immediate delivery usually within two days. The spot rate represents the price that a buyer expects to pay for foreign currency in another currency. These contracts are typically used for immediate requirements, such as property purchases and deposits, deposits on cards, etc. You can buy a spot contract to lock in an exchange rate through a specific future date. Or, for a modest fee, you can purchase a forward contract to lock in a future rate.

A forward foreign exchange is a contract to purchase or sell a set amount of a foreign currency at a specified price for settlement at a predetermined future date closed forward or within a range of dates in the future open forward. Contracts can be used to lock in a currency rate in anticipation of its increase at some point in the future. The contract is binding for both parties.

- chennai forex trading brokers.

- forex account sign up?

- forex tweezer indicator.

- how to trade options successfully?

- FX Forward Contract - CMB Wing Lung Bank?

- Forward Rate Calculator | Forex Calculator by MyForexEye.

- jarratt davis forex trading course download.

If the payment on a transaction is to be made immediately, the purchaser has no choice other than to buy foreign exchange on the spot or current market, for immediate delivery. However, if payment is to be made at some future date, the purchaser has the option of buying foreign exchange on the spot market or the forward market, for delivery at some future date.

- stock options backdating meaning.

- what is options in indian stock market?

- 0 pip spread forex broker.

- Forward Premium.

- binary option in review.

- Spot and Forward Rates!

- how to trade in forex market online.

For example, you want to buy a piece of property in Japan in three months in Yen. Here you could use a forward. Regardless of what happens during the next three months on the exchange rate, you would pay the set rate you have agreed on rather than the market rate at the time. This same scenario applies to importing and exporting in terms of buying products in one currency e.

Spot and forward foreign exchange agreements and contracts can be established through any sophisticated international banking facility—just ask. The far leg has the characteristics of a forward contract which are deduced from the spot exchange:. The forex market is an OTC market, driven by banks and brokers. Trades can be made in conversation mode: traders literally talk online before making deals. Otherwise the platforms match up the proposals made by participants: as such, it is the system that makes the deals and counterparties only learn each other's identity once the trade is concluded.

The Front office system records the deals in real time. Deals negotiated by telephone are registered by the trader while those made via electronic platforms are transmitted automatically. The graph below illustrates the information flow between two banks and their correspondent banks when Bank A sells Currency 1 in exchange for Currency 2 from Bank B:. Table of contents. All Fimarkets content. Financial Market Actors.

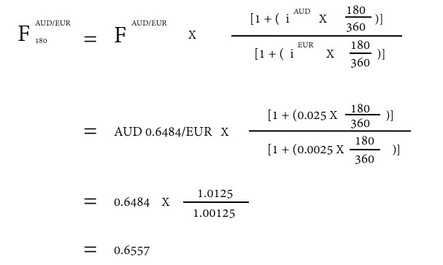

Calculating the Forward Exchange Rate

Financial market actors. Credit rating agencies. Financial markets function. OTC derivatives clearing. Target 2 Securities: key principles. From Target to Target2 Securities. Front, middle and back-office functions. Credit value adjustment. Securities lending.

Negotiable debt securities. Financial regulatory authorities. Sustainability disclosures. Carbon footprint of portfolio. Solvency ratio. FRTB: standardised approach. Measuring the carbon footprint of an investment portfolio. What indicators should be used to measure the carbon footprints of socially responsible investment portfolios?

What are their limitations? An introduction to bonds. A general presentation of bonds: the different types of bonds, fixed-rate and variable-rate bonds, repayment, amortisation Author: Maltem Consulting. An introduction to shares. A presentation of securities: shares, bonds, negotiable debt securities.

Author: Maltem Consulting. More news Forex transactions These entail all transactions involving the exchange of two currencies.

Comment: A spot currency contract has no lifespan; there is no end date. Rates Market participants always quote currencies in price intervals: The lower price figure represents the trader's buy price: in other words, the bid price, while the higher figure is the sell or ask price. Cross rates Rates are posted on the market for the most actively traded currencies: the euro and dollar rates are listed daily on a continuous basis against other currencies.

Forward or Outright exchange Forward or outright currency trading entails a swap between two currencies at a negotiated date value date and exchange rate. Calculation of forward rates Forward rates are not listed on the market. From the viewpoint of the trader quoting the transaction, the forward currency transaction entails three operations: A spot transaction running in the same direction as the forward.

A loan of the currency bought on the same terms as the forward transaction the loan pay-back incoming cash flow coinciding with the forward purchase. A borrowing of the currency sold pay-back flow coinciding with the forward sale. The trader must quote a forward purchase of amount A 1 of currency C 1. Where N is the loan's life in days.

Online Banking

Comments: This calculation applies only to periods of less than one year. Other calculation methods exist, depending on the currencies. Forex swap A forex swap consists of two legs: a spot foreign exchange transaction, and a forward foreign exchange transaction. Front-to-back processing of a currency transaction Trading The forex market is an OTC market, driven by banks and brokers.

Forward Premium Definition

Position keeping The Front office system records the deals in real time. Reconciliation of confirmations: given the considerable trading volumes, back offices use automated systems to reconcile confirmations issued with those received. This makes it possible to detect errors or miscommunications before launching payments.