Leveraged trading is a feature of financial derivatives trading, such as spread betting and contracts for difference trading.

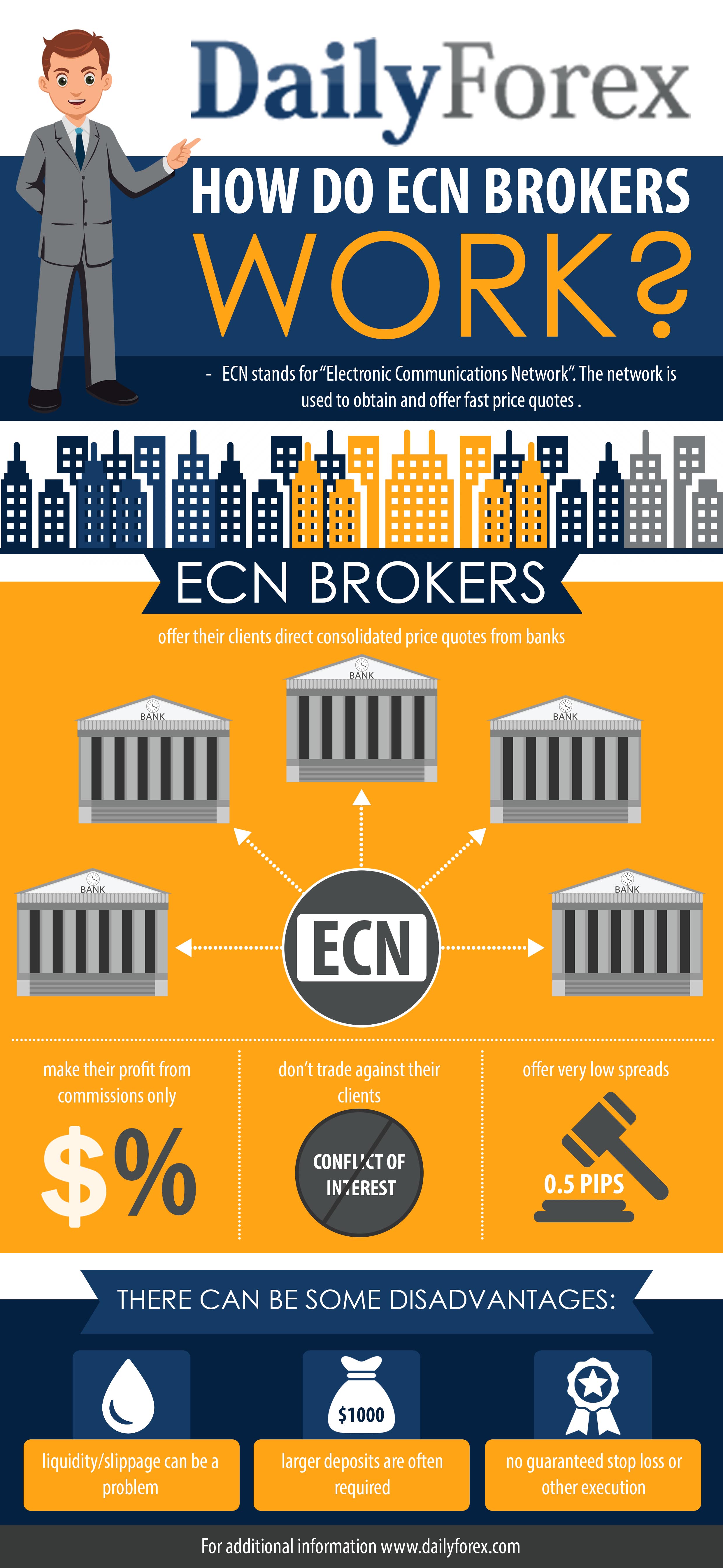

All About ECN Brokers – How They Work and Benefits

Leverage can also be used to take a position across a range of asset classes other than forex, including stocks, indices and commodities. Calculating the amount of margin needed on a trade is easier with a forex margin calculator. Most brokers now offer forex margin calculators or state the margin required automatically, meaning that traders no longer have to calculate forex margin manually. To calculate forex margin with a forex margin calculator, a trader simply enters the currency pair, the trade currency, the trade size in units and the leverage into the calculator.

The forex margin calculator will then calculate the amount of margin required. The currency pair is trading at 1. Forex margin calculators are useful for calculating the margin required to open new positions. They also help traders manage their trades and determine optimal position size and leverage level. Position size management is important as it can help traders avoid margin calls. Before you start speculating on the foreign exchange market, it would help to get a better understanding of technical analysis, as well as risk management , so you can better analyse price action and protect yourself from sudden market moves.

In leveraged forex trading, margin is one of the most important concepts to understand. Margin is essentially the amount of money that a trader needs to put forward in order to place a trade and maintain the position. Margin is not a transaction cost, but rather a security deposit that the broker holds while a forex trade is open.

Trading currencies on margin enables traders to increase their exposure. Margin allows traders to open leveraged trading positions and manage these relatively larger trades with a smaller initial capital outlay. If a broker offers a margin of 3. Margin level refers to the amount of funds that a trader has left available to open further positions. Trading forex on margin is a popular strategy, as the use of leverage to take larger positions can be profitable. Traders should take time to understand how margin works before trading using leverage in the foreign exchange market.

Traders need to be aware that their forex positions could be liquidated if their margin level falls below the minimum level required. Experience our powerful online platform with pattern recognition scanner, price alerts and module linking. Start trading on a demo account. Disclaimer CMC Markets is an execution-only service provider.

The material whether or not it states any opinions is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is or should be considered to be financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

What is ethereum? What are the risks?

Cryptocurrency trading examples What are cryptocurrencies? The advance of cryptos. How do I fund my account? How do I place a trade? Do you offer a demo account? How can I switch accounts? Search for something. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

Home Learn Learn forex trading What is margin in forex. What is margin in forex? Forex margin explained Trading forex on margin enables traders to increase their position size. What is the margin level?

What is Forex?

Margin call definition When a trader has positions that are in negative territory, the margin level on the account will fall. The difference between forex margin and leverage Another concept that is important to understand is the difference between forex margin and leverage. Typically, the higher the minimum deposit is on an account type, the better the trading conditions tend to be in terms of spread, fees, and any bonuses available.

You may also have the chance to choose your trading platform with most major brokers offering the top trading platforms from Metatrader of MT4, and MT5, as well as cTrader. Some brokers will also have their own proprietary trading platforms that you can trade through which can be very user-friendly for new traders too.

The last step in opening an account with any forex broker is to make your deposit. Again, the top forex brokers usually make a range of deposit options available to traders. These can include bank wire transfers, credit and debit cards, or eWallet methods like PayPal and Neteller that are commonly found. This can make sure you receive the best possible value for your money when making a deposit.

How to Choose a Forex Broker: Everything You Need to Know

On this point though, you should also check with your own bank about their fee policy particularly if you are making a wire transfer. City Index — UK. Authorised and Regulated by the Financial Conduct Authority. Capital at risk. City Index — Australia. City Index — Singapore.

Tel: Fax: The final step in the process of getting involved in forex trading is to open your forex broker account.

This means you will have selected your broker, and perhaps even tried their demo account, and you are now ready to open your own live trading account and start trading for real. If that is the case, then the process is quite simple, though there are a few steps you should follow. The process of opening a forex trading account can be pretty fast, though there are a couple of documents that you should be sure to have prepared to make the process as easy as possible.

All major forex brokers will ask for the following:.

What Is Forex Trading?

Once you have completed verification, you will be completely free to trade on your new account. Forex trading from an outside perspective may appear to be a complex, even daunting sector to start trading in. The reality is that, with some of the basic knowledge provided, and the help and educational infrastructure of a top forex broker, you can easily become involved. Once you have made the first steps in forex trading, you can also be open to much of the great potential that a market with trillions of dollars in daily trading volume can bring.

We also have a number of other trading articles that can really help you learn and grow on the next steps of your journey as a forex trader. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies , there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses.

Some of the links in this website either through images, text, audio or video are affiliate links. This means if you click on the link and purchase the item, the owner of this website will receive an affiliate commission. To learn more visit our affiliate disclosure page. What Makes Gold Valuable?

Why you should trade with an ECN broker?

Meet the Team Contact Us. Connect with us. Forex Table Of Contents. Terminology of Forex Trading Before you can walk the walk, it is always good to be able to talk the talk. Here is a basic rundown of a few terms that you are most likely to encounter along the way: The Forex Market The forex market is the market on which you are trading.

Forex Broker A forex broker is your link to the forex market, due to licensing requirements different brokers can only accept clients from specific regions. Currency Pairs Currencies within the forex market are always traded in pairs. Leverage When we talk about leverage in forex , in the most basic of terms it means the additional money that you can borrow from your broker based on the balance of your account. Margin Margin in forex trading is invariably linked to leverage also. Spread When trading forex you will always see two prices, the buy, and the sell price.

How to Get Started in Forex Trading Armed with all of the most common terms in the industry, you are now well placed to start your journey as a forex trader. Choosing a Regulated Broker With forex trading being completely decentralized, that means there is no one authority overseeing the market and the operations of the many forex brokers within that market. Consider all of the Trading Conditions Every forex broker will of course have their own trading conditions. Try a Demo Forex Trading Account First One of the best ways to get started and completely risk-free, is to select a forex broker who offers a good quality demo account.

Account Funding The last step in opening an account with any forex broker is to make your deposit. Trusted Forex Brokers Forex. Opening your Forex Broker Account The final step in the process of getting involved in forex trading is to open your forex broker account. Prepare Your Documents The process of opening a forex trading account can be pretty fast, though there are a couple of documents that you should be sure to have prepared to make the process as easy as possible.

Brokers to Avoid These brokers should be avoided at all cost 53option. Spread the love.