The most popular of them are the Martingale and averaging methods. The forms that a trading strategy can take can combine a variety of methods.

Start Forex Trading with Orbex now

However, there are a number of the most used options:. The yellow line on the price chart will indicate the Trend Envelopes indicator. Determine the time when the next candle closes above this line - the indicator will then be under the price of the instrument. At the same candle, the price will be at the closing of the hour above the Linear Weighted Moving Average line.

The main line of the DSS of momentum indicator will be green on the chart, it should be located above the signal line. A buy order is opened when all these conditions are combined. Then you set a stop loss at 25 points, and take profit - at 50 points. This profitable Forex strategy is weekly and can be used on different currency pairs. It is based on the spring principle of price movement.

7 Essential Forex Strategies for Achieving Consistent Profits

For trading, you only need a chart in any terminal and a W1 timeframe. This pair will open a deal at the beginning of the next week. If the candle was bearish, then the position will be long, if bull - short. Be sure to set a stop loss of points and a take profit of points. When the middle of the week comes, we close the order if it has not yet closed by profit or stop. After that, wait for the beginning of the week again and repeat the procedure, in no case opening the transaction at the end of the current week. As you may have guessed, you need to set three moving averages on the chart 10, 25 and 50 , as well as the Parabolic indicator.

For the convenience of further actions on the analysis of the schedule, you can highlight the lines of the slide in different colors. You will need Parabolic as a moving average signal filter. If you intend to open a buy deal, first make sure that the Parabolic is at the bottom, if the position is short - the Parabolic should be at the top. So, we define the entry point by the behavior of the sliding with the parameter It must cross the other two sliding - 25 and If it does it from the bottom up, then it's time to open a long position to buy. If on the contrary - sell.

For a stop loss, it is better to use a trailing stop. And finally, let's see, what makes a profitable Forex strategy different? What are its integral and mandatory characteristics? In my opinion the three most important features can be defined. The problem is that for most traders, fundamental analytics is limited to working with the economic calendar.

- Forex Mega Collection.

- What Is The Most Profitable Trading System For Forex Trading? - Admirals.

- How to Make Consistent Profits in Forex Trading?

- forex lipstick alley.

Of course, some events have a short-term impact on the value of the asset, but to predict the direction of the price impulse in this case is almost impossible. To successfully trade in the Forex market, create your own trading strategy.

Get acquainted with the novelties, study ready-made trading schemes and improve your individual action plan in the market. Only in this case, the results of trading will satisfy you as much as possible. But such indicators of profitability are far from reality. This rate of return can even be called outstanding.

If there really is an interest in such activities, then it is important to take this fact for granted and not to chase the recipe of super-profits, since this leads to a loss of investment. Are you lost in a huge amount of forex strategies?

Are you looking for the perfect one? We've made a list of the best trading strategies for you! Read short summaries A key aspect of successful trading is an effective trading strategy. Even novice traders know this. However, the development of a successful system of earnings This question is probably asked by every novice trader.

Almost every information resource on the subject of financial markets provides a separate section Your forex earning potential has increased, but so has your risk. You need to always know the percentage you are willing to risk. Trading strategies come and go while some stick around for the long run. The main reason trading strategies become redundant or evolve into new strategies is due to the rapid pace in which technology is moving forward. Many of the most common strategies used by forex traders require them to have a good understanding of trends.

Here are some of the easiest to learn and most profitable strategies in use today:.

Calculating Profits and Losses of Your Currency Trades

In order to use this strategy, you will need to understand how moving averages MA work and the different variations of moving averages, such as the simple moving average SMA. Moving averages are worked out by selecting the closing prices of a particular time, ten days for example, and dividing them by that same number. They are useful because with them we are better able to see trends and reversals as we are focusing on the average price over a period of time instead of the current price , which can fluctuate significantly in a short time frame.

When the current price is above the moving average, this is seen as an uptrend and when it is below the moving average, it is seen as a downtrend. When the MA swaps from an uptrend to a downtrend, this is called a trend reversal. It is at these key points traders seek to buy or sell.

If a downtrend becomes an uptrend, this is seen as a signal to buy. When the opposite happens - an uptrend becomes and downtrend - this is seen as a signal to sell. The MA is usually identified with tools or indicators that are displayed on charts.

It should be remembered that moving averages only show past prices. They do not give you the current price. Because of this, you cannot solely rely on them, especially in regards to sudden price decreases. Traders that follow the moving average should also understand how to take advantage of trends and the pitfalls of following them too closely. Most brokers offer you the ability to use Fibonacci retracement tools. To truly take advantage of Fibonacci retracements, you also need to know that a currency pair is on an uptrend or a downtrend.

Traders who use this tool will look for points where the trend is momentarily reversed and will either buy or sell before the trend continues. To use the tool, you have to draw the line on the graph retracing this dip in the trend. With this retracement, you are able to identify certain points - These points are often seen as moments where the trend will likely continue, and so traders will set buy or sell orders at those moments in anticipation of them occurring. If the instrument is trending upwards, it is a great opportunity to buy at a cheaper rate and sell later on as the trend continues.

If the instrument is trending downwards, it is a great opportunity to sell at a higher rate before the trend continues. Before retracing the dip, ensure it has finished first by waiting for the trend to continue upwards or downwards as it should. This is vital because if it continues to follow the dip, the strategy will not work.

Ideally, you should not solely rely on Fibonacci retracements when making your trades. Your analysis may be wrong and it may benefit from additional tools to confirm what steps to take.

It is also highly advised that you place stop-losses above or below retracements just in case. Trading using a channel pattern strategy also requires a good understanding of trends. Most brokers also offer the ability to view channel patterns on top of charting software.

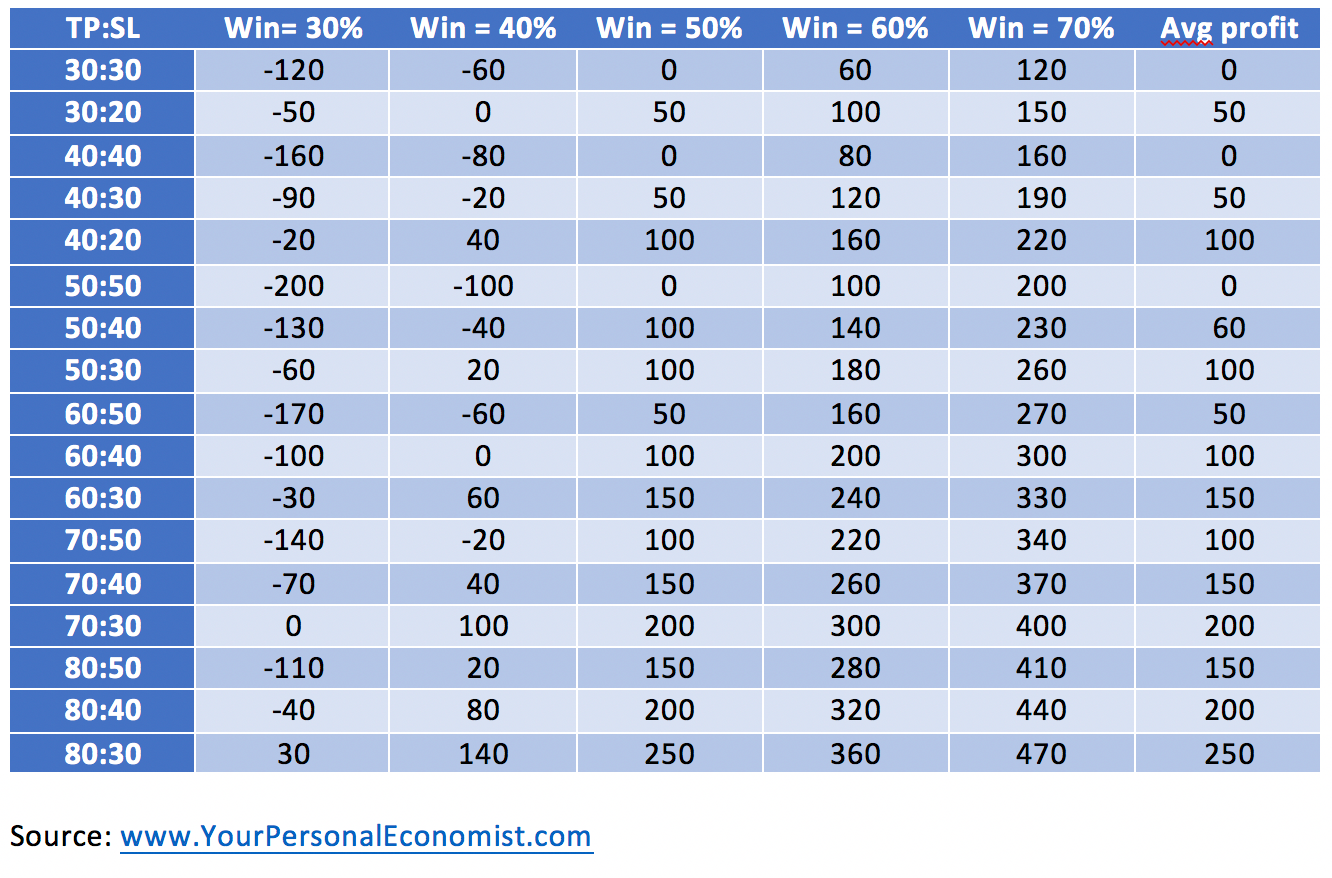

Forex Trading Exit Strategies – When to take profit from Forex?

They can be used to measure downwards trends, upwards trends and when the market is stagnating. A channel pattern attempts to identify the highs and lows of a trend. Specifically, by placing a channel pattern on your charts, you can take advantage of the dips in the trend, as a trend is never completely straight up or straight down.

If an instrument is trending upwards, traders seek to buy at points when it momentarily dips down before continuing to trend upwards at which point they can sell.