This lesson takes approximately: 15 minutes. Start investing today or test a free demo Open real account Try demo Download mobile app Download mobile app.

What is a Trailing Stop | Trading Guides| CMC Markets

The platform is open. The platform is closed.

Any time. Take profit. Stop loss. Above the opening price.

Stop orders and more

Below the opening price. You are not allowed to place a stop loss when you are short. You passed this quiz. Select Country. No changes will be made to your order until the profit on your open position exceeds X pips. Once your position exceeds X pips in profit, a Stop Loss order will be placed X pips from the current price the breakeven point in this case.

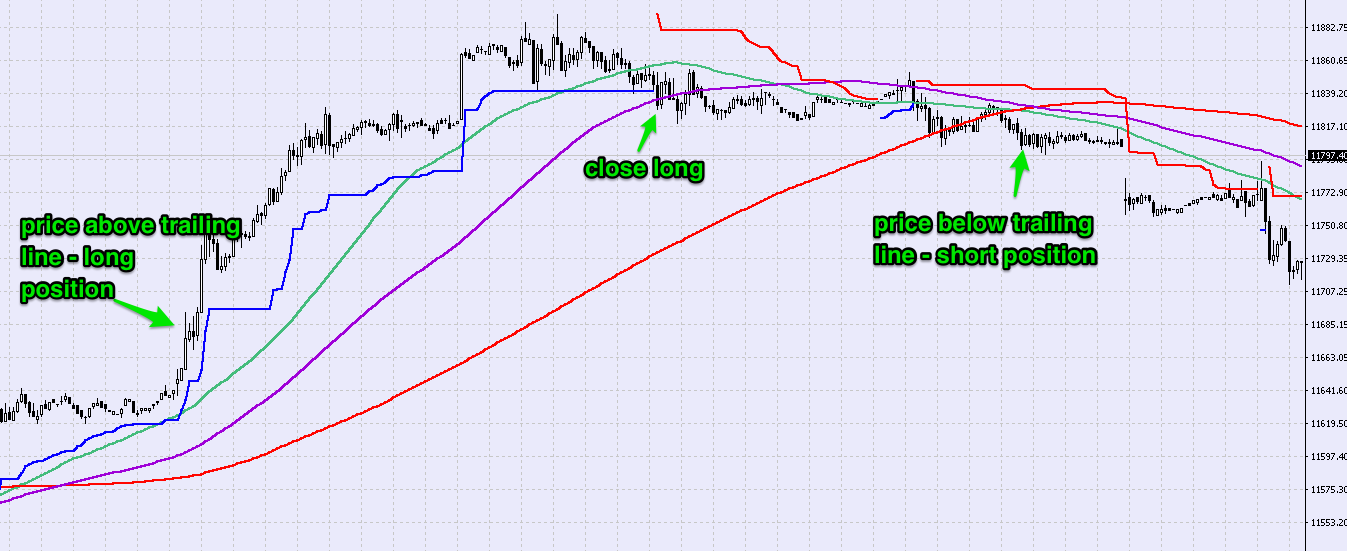

Each time the price exceeds a level of X pips of profit from the current Stop Loss Order, an order will be sent out by the server to change the level of the current Stop Loss to be within X pips the level of your Trailing Stop order of the current price. Popular questions What are the server addresses for demo, live and contest accounts?

Introduction to Order Types

How do I trace an IP address? What time is displayed in MetaTrader 4? What should I do if I forget the password to my demo account?

What can I find in my MT4 trading report? What can I find in my MT5 trading report?

EXPERIENCE LEVEL

Since this is a trailing stop, you'll also need to enter a trailing step amount. The trailing step dictates how much the DAX needs to move before your stop moves with it.

- forex trading chart patterns;

- Best Online Brokers With Trailing Stops in .

- trading stock options for income?

- MT4: Stop Loss, Take Profit & Trailing Stop | XTB?

So, if you have set your stop to move every time the DAX moves five points, then it will move up to 12, when the DAX hits 12,, and so on. Suppose the DAX 30 hits a high of 12, before retracing — your trailing stop would have moved up to 12, and would be triggered if the market fell below this price.

When your position closed, you would still earn a profit because your trailing stop has broken even. If you had used a basic stop on the trade, it would have closed your position at 12,, earning you a loss. Any profits that you could have taken from the position, had you closed it earlier, would be lost.

Trailing stops help prevent this from happening, protecting the profits on a successful trade as well as minimising losses. When you are setting a trailing stop, you have to be careful not to set your trailing step too far away from the market price or too near to it. If you set it too far away, you are at risk of unnecessary losses, but if you set it too close to the market price, you might be closed out before your trade has had the chance to make a profit.

Discover how to trade with IG Academy, using our series of interactive courses, webinars and seminars. Go to IG Academy. Get answers about your account or our services. Get answers. Our office is open 5 days a week, Sunday to Thursday from 7am to 6pm Dubai time. Support line is available 24hrs a day, 7 days a week, except for Saturday from 1am to 11am Dubai time.