This means that currency pairs cannot be traded in isolation. This does not mean that a currency value will change at the same rate against all other currency pairs.

- Correlation Forex Trading?

- option trading training chicago.

- Forex Currency Correlation.

- Get FREE Trading Signals.

For example, if the euro rises against the US dollar by pips, it does not mean that there will be a pip increase against the Australian dollar. However, it will likely rise against the Australian dollar to a certain degree.

- forex trader salary uk.

- What Forex Pairs Are Correlated? (Double Your Profits) – Stay At Home Trader?

- Complete Guide to Currency Pair Correlation.

- Forex Pairs That Correlate.

Positive correlation means that two currency pairs move in the same direction — if one currency pair moves up, so does the other. Either scenario will result in the price of the euro increasing against the dollar. If there is less demand for the US dollar, then there will also be less demand for the US dollar against other currency pairs, because there will be less demand for the US dollar overall — it does not become weaker against one currency only.

A trader’s guide to currency pair correlations in the forex market

Negative correlation means that two currencies move in the opposite direction to each other — if one currency pair moves up, the other moves down. This is because the price of the USD is denoted differently for these two currency pairs. Due to correlation between different currency pairs, there are considerations that you have to take into account when trading more than one currency pair.

This means that if one currency pair moves against your trade, the other will too. Any profit made on one trade would be offset by the loss on the other.

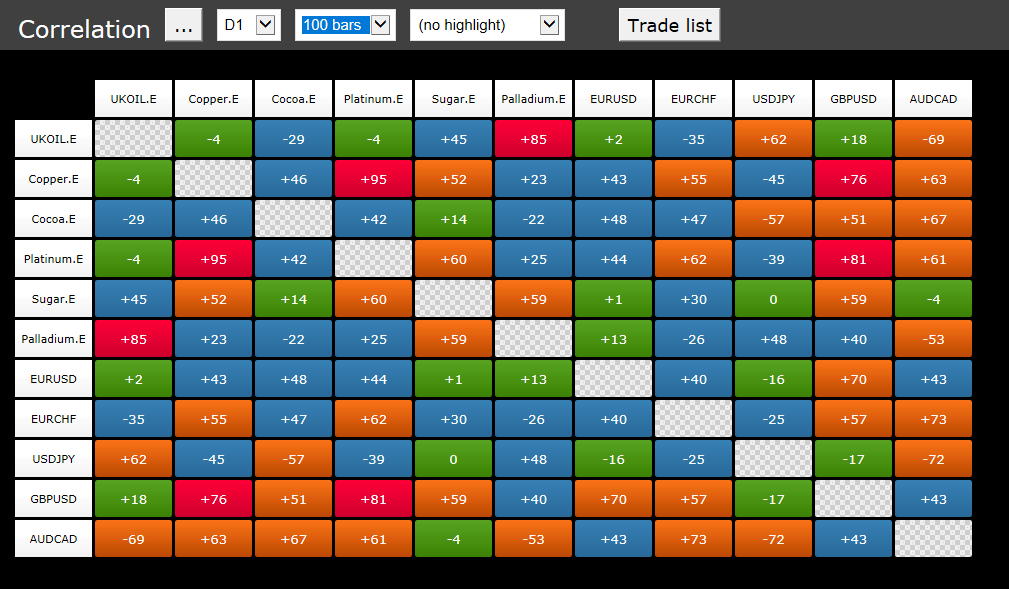

What is the correlation coefficient?

Opening up opposite positions on a strongly correlated currency pair is counter-productive. Any profit gained on one trade is likely to be offset from the loss on the other. The correlation between currency pairs is not exact.

Depending on the fundamentals behind them, a currency correlation can become stronger or weaker — they can also break down completely. Currency correlation can hold advantages when trading, because observing one currency pair can give you an insight into another, if they are correlated. Confirming trades and analysis Correlation can be used to confirm a trade, or your analysis, on a particular currency pair.

Currency Pair Correlations - Forex Trading

The idea is to look at whether the positively correlating pairs are moving together with the currency pair that you are watching. So if you are observing a currency pair move down, you can use other currency pairs that positively correlate to see if they are also moving down, confirming that your analysis is correct. You observe that the price is moving down and you are considering whether to enter a short trade. If there is, that means that the move is most likely due to a fundamental factor, making it more likely that a trend will be established.

The chart below shows an example of all three currency pairs moving in the same direction, making it more likely that a short trade will work out. Correlation can also be used to keep you out of bad trades, such as a false breakout.

If you are observing a currency pair that has been in a range and you observe a breakout to the upside, you can use positively correlating pairs to see if they have also broken to the upside. By using currency correlation, you can avoid bad trades.

OctaFX gives you the EDGE

Tradimo helps people to actively take control of their financial future by teaching them how to trade, invest and manage their personal finance. Risk warning: Trading in financial instruments carries a high level of risk to your capital with the possibility of losing more than your initial investment. Trading in financial instruments may not be suitable for all investors, and is only intended for people over Please ensure that you are fully aware of the risks involved and, if necessary, seek independent financial advice. A correlation coefficient of -1 indicates that the currency pairs are perfectly negatively correlated, that is, a higher value for one pair tends to correspond to a lower value for the other.

A correlation coefficient of 1 means that they are perfectly correlated, indicating a higher value for one variable tends to correspond to a higher value for the other. The weaker the relationship, the closer the correlation coefficient is to 0. Scroll the chart to fix the zero percent point to the moment you wish the start of the week, the start of the day or the current market session.

Forex Pairs That Correlate | Find Out The Best Ones In

Feel free to build you own comparative charts using the interactive charting tool. Knowing how closely correlated the currency pairs are in your portfolio is a great way to measure your exposure and risk. You might think that you're diversifying your portfolio by investing in different pairs, but many of them have a tendency to move in the same or opposite direction to one another. The correlations between pairs can be strong or weak and last for weeks, months, or even years. In the years past under high interest rates, stock prices and the USD did enjoy a positive correlation as foreign investment capital that finds its way into US businesses, US stocks, and ultimately the USD.