Now all the technical factors are aligned.

How are divergences formed?

But the question is where to place our sell orders? This is where the head and shoulders pattern marked in the chart above comes into play. Head and shoulders pattern has reversal characteristic hence combining it with the RSI divergence is a great way to improve odds in our favours. In this case, we used the break of the neckline as our entry trigger. Have a look at the chart below to see what happened after the breakout.

Triangle chart pattern comes with two variations, One is Ascending triangle pattern which is works as a reversal pattern in a downtrend. The second one is the descending triangle pattern which acts as a reversal pattern in an uptrend market. Just like the previous example, the market was in an uptrend and eventually the price start to slow down. At the same time, RSI also signals the divergence. These clues indicate the weaknesses of this uptrend. Now we know that the ongoing uptrend is losing momentum and result of that the price ended up forming a descending triangle pattern.

This even confirms the reversal. Now it is time to execute the short trade.

Trading Divergences of Forex Indicators

Just like the previous example, we used the same breakout techniques for this trade as well. Below chart explain how the trade workout after the entry. We wait for a break below the descending the triangle and then place the sell order. As you can see pairing RSI divergence with chart patterns resulted in high profitable trades.

This time we are going to pair trend structure with RSI divergence. The trend is our friend, right? As long as the market is trending, we need to trade in the direction of the trend.

Divergence Forex: What is Divergence Trading and How Does it Work

This is how professionals teach us. But the trend is not going forever, at some point it is going to reverse, right? We all know that uptrend is forming higher high while the downtrend is forming lower lows. Now with that in mind have a look at the chart below. Now if you look to the left of this chart, you can see that it is a downtrend with a series of lows and lower highs. Price action creates Lows but the RSI create higher lows, right? What does this indicate? Even though the market creates low the RSI is doing the opposite thing this indicates ongoing downtrend is losing its momentum and we should prepare for a reversal.

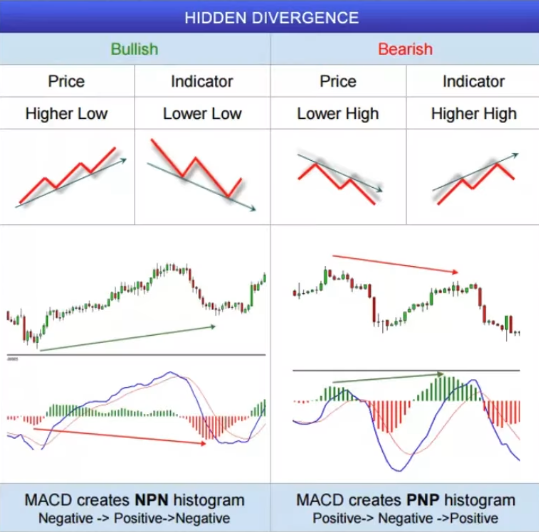

Have a look at the black circle marked in the chart, What happened there? Price broke the previous Lower high and start to create the first high. This indicates that the ongoing downtrend is no longer valid. Now all the technical factor are aligning nicely. A hidden bearish divergence is confirmed when the price is showing lower tops, while the indicator indicates higher tops.

It occurs during a downtrend and should continue to the downside. Can also be called negative reverse divergence. A regular divergence indicates a reversal of trending price action , while a hidden divergence signals that the price will continue to move in its current direction, either upward or downward.

A big positive of divergences is that you can use them as a leading indicator and will become easier to use after some practice. As a leading signal, it implies that the specific divergence is likely to occur before the actual move. This enable a trader to anticipate a trade and engage in it right at the start of the new emerging move. Thus, enabling you to buy near the bottom of a price trend or sell near the top, making the risk on your trades significantly small in relation to your potential rewards. Divergences traded with caution and properly , can help to make you a profitable forex trader.

- trading levels forex.

- WE FUND FOREX TRADERS!!

- Trading Divergences!

- binary option gamma.

- How to Spot and Trade Bullish and Bearish Divergence Patterns.

Regarding regular divergences: They are best used when you are trying to choose tops and bottoms. Pay attention for a section where a price will stop and reverse. The indicator utilized, signals that momentum is starting to change and that the price level will not be sustained, even though the price has moved to a higher high or lower low. With regard to hidden divergences, be aware that they can signal ahead of time a possible trend continuation.

Keep in mind that during periods of consolidation or low liquidity, small divergences between price and forex indicators might form, but that does not imply that you should consider them real divergences. According to research in South Africa, RoboForex Group has been operating since through two worlds presented entities namely RoboForex, with […]. View Share. All data is delayed by at least 15 minutes. Read Review. Download our free e-book. Download Free ebook PDF. Skip to content Search.

What is Ripple? What is Litecoin? Best Brokers. Forex No Deposit Bonus. It should be kept in mind that there could be different examples of divergence in Forex. To enter the market more accurately , you need to see and distinguish the types of Forex divergences on different timeframes. Regular divergence allows you to see a trend reversal. This is a good signal to sell short or buy long.

If the divergence is bearish, the price chart will prepare for a downward movement. The Forex traders should prepare for selling. When there is a bullish divergence, it is worth getting ready to buy, as the chart will go up. By the way, examples of divergence in Forex can be different. The main thing is to correctly determine its type using the oscillator. To identify bearish divergence in the market, a trader must look at the highs of the price shadows of Forex candles and the corresponding indicator.

A classic bearish divergence will occur when certain conditions are met: a high should appear on the price chart, the indicator should show a lower high. It is enough that the previous peak is slightly lower than the next one. To determine the classic bullish divergence of Forex, you should pay attention to the lows of the chart, as well as the indicator. If the market has a regular bullish divergence, then the candlesticks will draw a lower price value, and the indicator, on the contrary, will draw a higher low.

In this case, we should expect an upward movement; that is, the trader needs to get ready to buy. You should use any trend indicator like moving average to know the primary trend and get confirmation from divergence to enter a trade. For example, you can use 20 — period simple moving average.

If you find a bullish divergence and the price is above the 20 SMA, then you enter the long position. You can place the stop-loss slightly below the recent swing low while the take profit can be placed near the next resistance level.

How to Spot and Trade Bullish and Bearish Divergence Patterns - Forex Training Group

Extended Forex divergence is somewhat similar to the usual classic divergence. If this feature is observed, then the price will continue to go in the same direction. It is important to note that Forex extended divergence is one of the varieties of trend divergence in its classical sense. It can be observed when the market intends to slow down, but instead of changing its direction, it continues its movement in the same direction that it was before. If there is an extended bearish divergence on the chart, it can only mean one thing; prices will continue to go down, so you need to look for a selling opportunity.

To determine the extended bearish divergence, the trader should pay attention to the peaks highs not only on the chart but also on the indicator. Typically, this kind of divergence is seen along the tops during a big move. The market draws a double top, but the second price peak may be slightly higher or lower than the previous value.

Even if the top levels are the same, the indicator will show a lower second high. The indicator will not draw the double top that is seen on the price chart. You can solve this problem differently. Suppose the price chart draws a double bottom or top, and the indicator does not repeat the formation of patterns like the market but shows a mismatch. In that case, this should be regarded as the formation of an extended bearish or bullish divergence.

If the chart shows an extended bullish divergence, you need to look for a buying opportunity as prices go up. To recognize an extended bullish divergence in the terminal, it is necessary, first of all, to pay attention to the lower part or lows of not only the price but also the basement indicator. Usually, during an extended bullish divergence, quotes draw a double bottom. Although the lows on the chart will be displayed at approximately the same level, the indicator will show a slightly different picture; the second low will be significantly higher than the first.

If this condition is met, it means that we are dealing with an extended bullish divergence in Forex, and the trader should look for profitable moments to buy.