Enter your details below and select your area s of interest to stay ahead of the curve and receive Law's daily newsletters. First Name.

FMSB publishes second standard for wholesale FICC markets

Last Name. Password at least 8 characters required. Confirm Password. Law may contact you in your professional capacity with information about our other products, services and events that we believe may be of interest. We take your privacy seriously. Please see our Privacy Policy.

Law takes your privacy seriously. Financial Services Body Finalizes New Bond Issue Standard Law, London July 3, , PM BST -- A private sector financial services body warned London's banks and traders on Tuesday about potential conflicts of interest that could arise when they enter into transactions to mitigate risks during the issuance of bonds, as it finalized a new standard for the wholesale markets.

The Fixed Income, Currency and Commodities Markets Standards Board has published its latest standard aimed at helping traders identify and manage potential conduct risks and conflicts of interest when using risk management transactions. The new standard will apply to all traders at member firms that are directly involved in RMTs linked to syndicated offerings of fixed income Stay ahead of the curve In the legal profession, information is the key to success. Access to case data within articles numbers, filings, courts, nature of suit, and more. Access to attached documents such as briefs, petitions, complaints, decisions, motions, etc.

Create custom alerts for specific article and case topics and so much more! Citigroup Inc. I'm Law's automated support bot. How can I help you today?

Cookie preferences

For example, you can type: I forgot my password I took a free trial but didn't get a verification email How do I sign up for a newsletter? Get instant access to the one-stop news source for business lawyers Register Now! Sign up now for free access to this content Enter your details below and select your area s of interest to stay ahead of the curve and receive Law's daily newsletters.

First Name Last Name. Password at least 8 characters required Confirm Password. Already have access?

Available CRAN Packages By Name

Email: Password: Forgot your password? Remember login. You must correct or enter the following before you can sign up:. We'll assume you're ok with this, but you may change your preferences at our Cookie Centre. Please read our Privacy Policy. The standard, which is being issued in draft form for comment, covers binary options in the commodities markets.

Binary options, also known as barrier or digital options, pay out a fixed amount, or nothing, depending on whether the underlying price of a commodity hits a pre-agreed level at a specific point in time. This creates an inherent conflict between the bank or dealer selling the option and the client. The new standard outlines the rationale for use of binary options and also makes clear the guidelines that market participants should follow to ensure they manage the conflict of interest in an appropriate fashion.

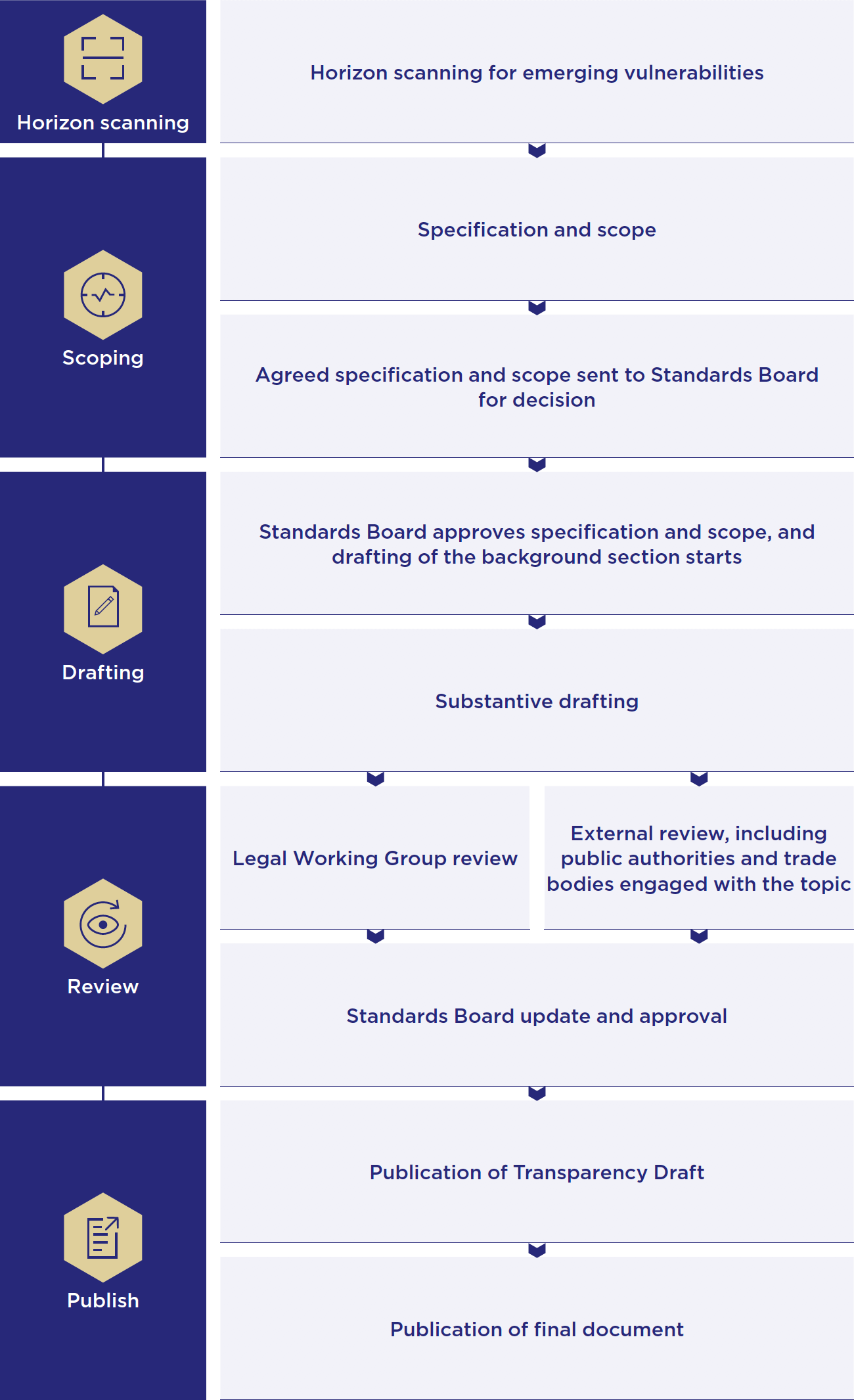

It is being issued in the form of a transparency draft to provide an opportunity for public comment ahead of final ratification and issuance. It does this by defining standards of good practice in contentious or grey areas of the markets. Last month, the FMSB published a standard on reference price transactions in the fixed income rates markets. These transactions involve agreeing all aspects of a transaction except price which is set later based on a pre-agreed reference price and market.

R language packages for Anaconda — Anaconda documentation

The standard set out guidance for practitioners about what is acceptable conduct in the context of these types of transaction and create greater clarity about what good market practice looks like, and what types of practice should be avoided. They include international users of the markets such as corporates, asset owners and asset managers, market infrastructure providers such as exchanges, custodians, and investment banks.

The FMSB is seeking comment from interested parties on the binary options standard over the summer. Submissions should be sent to standards fmsb.