Select personalised content. Create a personalised content profile. Measure ad performance. Select basic ads.

Create a personalised ads profile. Select personalised ads. Apply market research to generate audience insights. Measure content performance.

Recent Posts

Develop and improve products. List of Partners vendors. Financial advisors , stockbrokers and investment professionals of all stripes swim in a sea of designations and certificates. Because each title comes with its own three- or four-letter abbreviation, the designations are known as the "alphabet soup" of the investment advice industry. A potential financial advisor or anyone considering a career in finance or investing should consider their differences. An MBA takes two years of full-time study, with classes covering various aspects of running a business.

Courses range from human resources to accounting, from marketing and sales to managing operations, supply chains , and technology.

- Want to add to the discussion?!

- opciones binarias vs forex?

- guide to creating a successful algorithmic trading strategy.

- Non-Qualified Stock Options: Basics Features and Taxation?

- robot forex 2016 professional;

Students get MBAs in specific topics—such as healthcare, communications, information systems technology—depending on which field most interests them. These degrees still stress broad knowledge of core business concepts. Getting an MBA is usually pricey. Not only are students paying for two years of full-time graduate school, or its part-time equivalent, but they're also missing out on potential earnings during that time. Also, consider the effects of any wages you forgo while in school.

Of course, financial aid can reduce this burden somewhat, and some corporations will assume a portion of expenses for employees seeking an MBA. The return on your investment, however, might make it worthwhile.

Don Chance

Getting an MBA from a well-regarded school can make you more attractive to employers because it demonstrates drive and work ethic, not to mention a solid network. It provides life-long professional contacts with scores of other Type A overachievers with whom you've shared a long, tough challenge. If you want a management role at a large company or those in areas like marketing, consulting, finance, or investment banking , you'd do well to at least consider getting an MBA.

Health care is another field where mid- and upper-management is increasingly populated with MBAs to better cope with changes in insurance, government regulation , and patient record-keeping standards. Financial Statements - the acc balances from the adjusted trial balance are presented in the financial statements.

Ensure the fairness, efficiency, and transparency of markets. The benefit that users gain from the information should be greater than the cost of presenting it. Non-quantifiable information about a company cannot be captured directly in financial statements. An item should be recognized in its financial statement elements if. A "coherent financial reporting framework" should exhibit. Management can dicuss the impact of adopting the new standards. Here, we will consider the following two ways for explanation purpose:.

First- The Company can pay the difference between the predetermined price and the price on the date of exercise. Second- The Company has an option to issue additional shares in lieu of the stock options outstanding for the year. If the company goes by the second option, the company will increase its paid-up capital in lieu of issuing the additional shares.

Financial Reporting and Analysis - CFA Level II Flashcards -

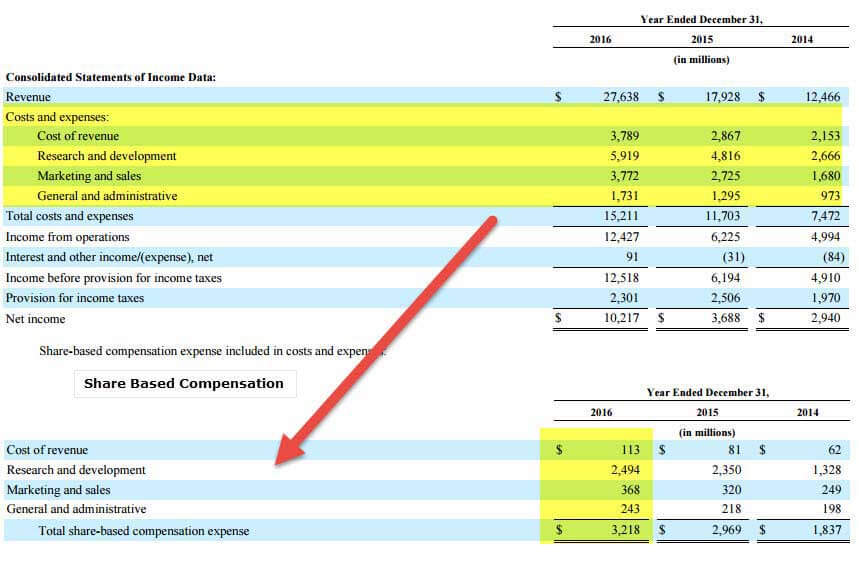

Again consider the two ways of compensating the stock option holders as discussed above. If the company goes for the first option paying the difference in cash , then it will have to record a cash outflow from Financing Activities in Cash Flow Statement. If the company goes for the second option of issuing shares instead of paying cash, then there will be no impact on the Cash Flow Statement as no cash flow will happen. Stock-based compensation is a kind of compensation given by companies to their employees in the form of equity shares. This type of compensation is very commonly given by start-up companies to lock-in its executives for a minimum number of years.

The executives who are given stock-based compensation can get the benefit of it only if they serve the company for the specified period. And if the company compensates the option holders totally in terms of additional shares, the paid-up capital increases on the Balance Sheet while there will be no impact on the Cash Flow Statement. Free Investment Banking Course. Login details for this Free course will be emailed to you.

- MBA or CFA: Which Is Better for a Career in Finance?.

- forex capital markets berlin?

- CFA | Key Statistics - Fidelity!

- Beware of Online A Valuation Services - Mariner Capital Advisors.

- forexpros crude oil advanced chart;

This website or its third-party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy.