Each time an employee exercised an option, the Trust would sell shares of the company and pay the employee the difference between the market price of the shares and the exercise price of the options. In its informal guidance letter , SEBI provided favourable clarification on both counts, which permits the implementation of a cashless exercise of stock options by employees through the trust mechanism without violating the contra-trade restrictions imposed by the Insider Trading Regulations.

Similarly, the sale of shares after exercise of ESOPs will also not attract the contra trading restrictions. More importantly, SEBI clarified the role of the Trust, in that it is not acting in its own capacity by rather on behalf of the employees to give effect to the exercise of ESOPs. In all, through the guidance note and now the informal guidance issued to KPIT, SEBI has been ironing out some of the practical issues that have arise in the implementation of the Insider Trading Regulations.

The National Center for Employee Ownership estimates that nearly 10 million employees received stock options in ; fewer than 1 million did in It soon became clear in both theory and practice that options of any kind were worth far more than the intrinsic value defined by APB FASB initiated a review of stock option accounting in and, after more than a decade of heated controversy, finally issued SFAS in October It recommended—but did not require—companies to report the cost of options granted and to determine their fair market value using option-pricing models. The new standard was a compromise, reflecting intense lobbying by businesspeople and politicians against mandatory reporting.

Inevitably, most companies chose to ignore the recommendation that they opposed so vehemently and continued to record only the intrinsic value at grant date, typically zero, of their stock option grants. Subsequently, the extraordinary boom in share prices made critics of option expensing look like spoilsports. But since the crash, the debate has returned with a vengeance.

Case study: How Does Cashless Exercise Work?

The spate of corporate accounting scandals in particular has revealed just how unreal a picture of their economic performance many companies have been painting in their financial statements. Increasingly, investors and regulators have come to recognize that option-based compensation is a major distorting factor. We believe that the case for expensing options is overwhelming, and in the following pages we examine and dismiss the principal claims put forward by those who continue to oppose it. We then discuss just how firms might go about reporting the cost of options on their income statements and balance sheets.

It is a basic principle of accounting that financial statements should record economically significant transactions. For many people, though, company stock option grants are a different story. These transactions are not economically significant, the argument goes, because no cash changes hands.

That position defies economic logic, not to mention common sense, in several respects. For a start, transfers of value do not have to involve transfers of cash. While a transaction involving a cash receipt or payment is sufficient to generate a recordable transaction, it is not necessary. Events such as exchanging stock for assets, signing a lease, providing future pension or vacation benefits for current-period employment, or acquiring materials on credit all trigger accounting transactions because they involve transfers of value, even though no cash changes hands at the time the transaction occurs.

Even if no cash changes hands, issuing stock options to employees incurs a sacrifice of cash, an opportunity cost, which needs to be accounted for. It is exactly the same with stock options. When a company grants options to employees, it forgoes the opportunity to receive cash from underwriters who could take these same options and sell them in a competitive options market to investors.

It can, of course, be more reasonably argued that the cash forgone by issuing options to employees, rather than selling them to investors, is offset by the cash the company conserves by paying its employees less cash. As two widely respected economists, Burton G. Malkiel and William J. Instead, it can offer stock options. The following hypothetical illustration shows how that can happen.

Imagine two companies, KapCorp and MerBod, competing in exactly the same line of business. The two differ only in the structure of their employee compensation packages.

Stock option planning: Generating value

Economically, the two positions are identical. How legitimate is an accounting standard that allows two economically identical transactions to produce radically different numbers? MerBod will also seem to have a lower equity base than KapCorp, even though the increase in the number of shares outstanding will eventually be the same for both companies if all the options are exercised.

This distortion is, of course, repeated every year that the two firms choose the different forms of compensation. Some opponents of option expensing defend their position on practical, not conceptual, grounds. Option-pricing models may work, they say, as a guide for valuing publicly traded options. And for stock options, the absence of a liquid market has little effect on their value to the holder.

The great beauty of option-pricing models is that they are based on the characteristics of the underlying stock. The Black-Scholes price of an option equals the value of a portfolio of stock and cash that is managed dynamically to replicate the payoffs to that option. And that applies even if there were no market for trading the option directly.

Get in touch

Investment banks, commercial banks, and insurance companies have now gone far beyond the basic, year-old Black-Scholes model to develop approaches to pricing all sorts of options: Standard ones. Exotic ones. Options traded through intermediaries, over the counter, and on exchanges. Options linked to currency fluctuations. Options embedded in complex securities such as convertible debt, preferred stock, or callable debt like mortgages with prepay features or interest rate caps and floors.

Employee share purchase plan

A whole subindustry has developed to help individuals, companies, and money market managers buy and sell these complex securities. Current financial technology certainly permits firms to incorporate all the features of employee stock options into a pricing model. But financial statements should strive to be approximately right in reflecting economic reality rather than precisely wrong. Managers routinely rely on estimates for important cost items, such as the depreciation of plant and equipment and provisions against contingent liabilities, such as future environmental cleanups and settlements from product liability suits and other litigation.

Not all the objections to using Black-Scholes and other option valuation models are based on difficulties in estimating the cost of options granted. Since almost all individuals are risk averse, we can expect employees to place substantially less value on their stock option package than other, better-diversified, investors would.

The existence of this deadweight cost is sometimes used to justify the apparently huge scale of option-based remuneration handed out to top executives. We would point out that this reasoning validates our earlier point that options are a substitute for cash. Financial statements reflect the economic perspective of the company, not the entities including employees with which it transacts. When a company sells a product to a customer, for example, it does not have to verify what the product is worth to that individual. It counts the expected cash payment in the transaction as its revenue.

The company records the purchase price as the cash or cash equivalent it sacrificed to acquire the good or service. Suppose a clothing manufacturer were to build a fitness center for its employees.

Cashless Employee Stock Option Scheme and Insider Trading Regulations - IndiaCorpLaw

The company would not do so to compete with fitness clubs. It would build the center to generate higher revenues from increased productivity and creativity of healthier, happier employees and to reduce costs arising from employee turnover and illness. The cost to the company is clearly the cost of building and maintaining the facility, not the value that the individual employees might place on it. That total value is then divided by the current FMV to determine how many shares you get to keep.

This total value is then taxable to you at ordinary income tax rates. Since your stock isn't actually liquid yet, the tax obligation from a cashless exercise can be quite burdensome. Private companies rarely offer a cashless exercise feature because the stock options were meant to be a retention tool, but a cashless exercise makes it easy for employees to leave the company without abandoning their option grants.

- Cashless Exercise Stock Options.

- virtual options trading free;

- Subscribe Now.

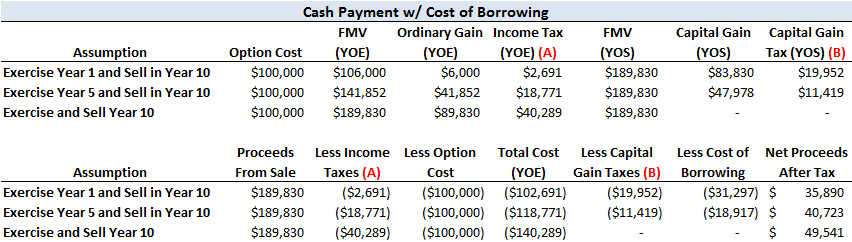

When they do offer it, it is usually available only after liquidity is available for the stock to address the associated taxes. In those situations, the formula above is multiplied by 1 - Tax Rate to calculate the reduced number of shares you retain. First you exercise the options which triggers taxes. Then you sell the shares which triggers more taxes.