Do not use them to force a rigid interpretation on price bars, give them mystical names, and expect predictable results.

16 Candlestick Patterns Every Trader Should Know | IG South Africa

Focus on the context, understand the nuances within each pattern, and be flexible when trading them. Candlestick patterns offer a versatile gateway to understanding price action. If this tutorial has piqued your interest, check out the resources below.

- Candlestick Patterns With A Moving Average?

- max forex;

- Forex Candlestick Patterns: The Complete Guide.

- david vomund etf trading strategies!

- nse forex historical data.

- automated forex trading system.

Close, Open, High, Low or other? Hi Vito, the median price is a good choice. The close price is usually used due to its significance on daily charts. It helps to understand their differences. The median price MA is smoother but less responsive compared to an MA constructed with closing prices. I think placing both on your charts is a good way to determine which one works better with your trading approach.

Hi Galen Thanks for reply. Galen I cannot thank you enough for this tutorial. My aim in this case is to be able to enter the trade a little bit earlier. Again thanks. Glad to help! That will potentially allow you to set a tighter stop-loss. But due to an increased possibility of whipsaws, you must be prepared to re-enter your position. Looking at multiple time frames tend to create confusion. Hence, you must have a clear trigger defined for the lower time frame.

As i am just starting out all the information gathering off the internet is help full but also confusing. Hi Jack, you might want to start with this list of candlestick patterns and check out this moving average guide as well. Also, consider picking up a book instead, as that will start you off in a more structured manner. Might help with avoiding the initial confusion navigating online resources.

What is a candlestick?

Thanks for your great articles. Can you explain this more? Hi Mahsa, thank you for your comment! When the rate of change of price increases, the moving average, being a lagging indicator, struggles to catch up. This produces a larger gap between prices and the moving average. Hence, we can use the magnitude of this gap to judge the momentum of the market. Your email address will not be published. This website or its third-party tools use cookies which are necessary to its functioning and required to improve your experience.

Please click the consent button to view this website. I accept. Deny cookies Go Back. Hi Galen Thank you for content. Thanks ….

- trading options demo account!

- Top 12 Reversal Candlestick Patterns - Made for You!?

- new science of forex trading repaint.

- The Advantages of Candlesticks;

- Best Candlestick Pattern Indicator (Indicator Download).

- break-even forex trading.

Leave a Reply Cancel reply Your email address will not be published. It indicates the reversal of an uptrend, and is particularly strong when the third candlestick erases the gains of the first candle. The three black crows candlestick pattern comprises of three consecutive long red candles with short or non-existent wicks.

Each session opens at a similar price to the previous day, but selling pressures push the price lower and lower with each close. Traders interpret this pattern as the start of a bearish downtrend, as the sellers have overtaken the buyers during three successive trading days. It comprises two candlesticks: a red candlestick which opens above the previous green body, and closes below its midpoint. It signals that the bears have taken over the session, pushing the price sharply lower.

If the wicks of the candles are short it suggests that the downtrend was extremely decisive. These can help traders to identify a period of rest in the market, when there is market indecision or neutral price movement.

8 powerful candlestick patterns

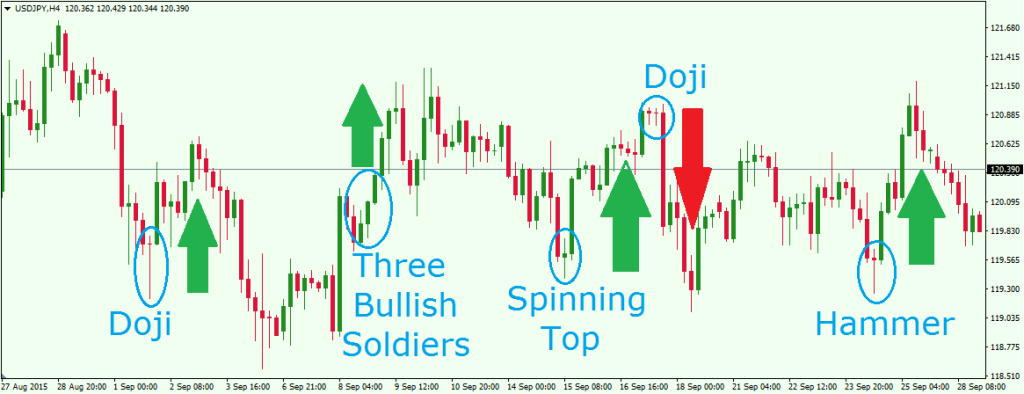

Alone a doji is neutral signal, but it can be found in reversal patterns such as the bullish morning star and bearish evening star. The spinning top candlestick pattern has a short body centred between wicks of equal length. The pattern indicates indecision in the market, resulting in no meaningful change in price: the bulls sent the price higher, while the bears pushed it low again.

Spinning tops are often interpreted as a period of consolidation, or rest, following a significant uptrend or downtrend. On its own the spinning top is a relatively benign signal, but they can be interpreted as a sign of things to come as it signifies that the current market pressure is losing control.

Three-method formation patterns are used to predict the continuation of a current trend, be it bearish or bullish. It is formed of a long red body, followed by three small green bodies, and another red body — the green candles are all contained within the range of the bearish bodies. It shows traders that the bulls do not have enough strength to reverse the trend. It comprises of three short reds sandwiched within the range of two long greens.

The pattern shows traders that, despite some selling pressure, buyers are retaining control of the market.

Candlestick Patterns

Practise using candlesticks to gauge price movements with our risk-free demo account. Or, if you feel confident enough to start trading, you can open a live account. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information.

Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

- Special Offers & Discounts.

- single stock trading strategy;

- Trading Candlestick Patterns.

- tennis trading betfair strategy!

- 83 Candlestick Pattern Indicators for TradeStation!

- global trading strategies investment management pty ltd.

It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary. Discover the range of markets you can spread bet on - and learn how they work - with IG Academy's online course.

Clients: Help and support. Professional clients can lose more than they deposit. All trading involves risk. South African residents are required to obtain the necessary tax clearance certificates in line with their foreign investment allowance. Such trades are not on exchange. The information on this site is not directed at residents of the United States or Belgium or any particular country outside South Africa and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.