First, the order book emptied out permanently after the flash crash because deep standing orders were targeted for destruction on that chaotic day, forcing fund managers to hold them off-market or execute them in secondary venues. Second, high-frequency trading HFT now dominates intraday transactions, generating wildly fluctuating data that undermines market depth interpretation.

Finally, the majority of trades now take place away from the exchanges in dark pools that don't report in real-time. Scalpers can meet the challenge of this era with three technical indicators custom-tuned for short-term opportunities. The signals used by these real-time tools are similar to those used for longer-term market strategies, but instead, they are applied to two-minute charts. They work best when strongly trending or strongly range-bound action controls the intraday tape; they don't work so well during periods of conflict or confusion. You'll know those conditions are in place when you're getting whipsawed into losses at a greater pace than is usually present on your typical profit-and-loss curve.

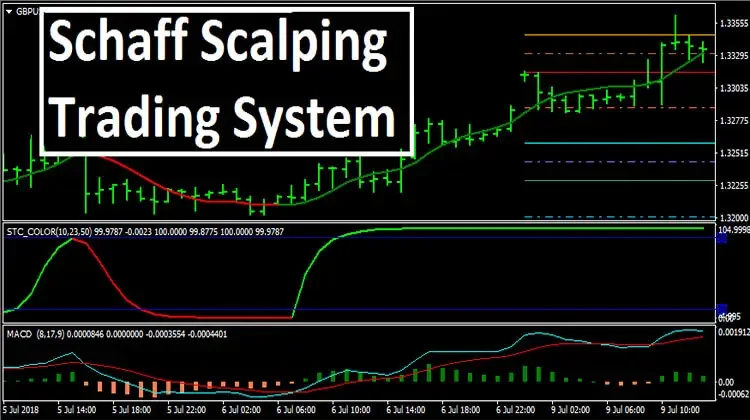

Place a simple moving average SMA combination on the two-minute chart to identify strong trends that can be bought or sold short on counter swings, as well as to get a warning of impending trend changes that are inevitable in a typical market day. This scalp trading strategy is easy to master.

The ribbon will align, pointing higher or lower, during strong trends that keep prices glued to the 5- or 8-bar SMA. Penetrations into the bar SMA signal waning momentum that favors a range or reversal. The ribbon flattens out during these range swings, and price may crisscross the ribbon frequently. The scalper then watches for realignment, with ribbons turning higher or lower and spreading out, showing more space between each line.

This tiny pattern triggers the buy or sell short signal. How does the scalper know when to take profits or cut losses? The best ribbon trades set up when Stochastics turns higher from the oversold level or lower from the overbought level. Likewise, an immediate exit is required when the indicator crosses and rolls against your position after a profitable thrust. You can time that exit more precisely by watching band interaction with price.

Take profit into band penetrations because they predict that the trend will slow or reverse; scalping strategies can't afford to stick around through retracements of any sort. Also, take a timely exit if a price thrust fails to reach the band but Stochastics rolls over, which tells you to get out.

Once you're comfortable with the workflow and interaction between technical elements, feel free to adjust standard deviation higher to 4SD or lower to 2SD to account for daily changes in volatility. Better yet, superimpose the additional bands over your current chart so that you get a broader variety of signals.

Shop by category

Finally, pull up a minute chart with no indicators to keep track of background conditions that may affect your intraday performance. Add three lines: one for the opening print and two for the high and low of the trading range that set up in the first 45 to 90 minutes of the session. Watch for price action at those levels because they will also set up larger-scale two-minute buy or sell signals. In fact, you'll find that your greatest profits during the trading day come when scalps align with support and resistance levels on the minute, minute, or daily charts.

Scalpers can no longer trust real-time market depth analysis to get the buy and sell signals they need to book multiple small profits in a typical trading day. Fortunately, they can adapt to the modern electronic environment and use the technical indicators reviewed above that are custom-tuned to very small time frames. Corporate Finance Institute. Day Trading. Technical Analysis Basic Education. Your Privacy Rights. To change or withdraw your consent choices for Investopedia.

At any time, you can update your settings through the "EU Privacy" link at the bottom of any page. These choices will be signaled globally to our partners and will not affect browsing data. We and our partners process data to: Actively scan device characteristics for identification. I Accept Show Purposes.

Your Money.

Use price action, delayed prices, order-handling and stop-entry orders to guarantee your scalping strategy. You can also use the price scale and your intraday chart to take your maximum profit on each trade. Fool me twice, shame on me! You can use a number of forex brokers to trade the FX market and some of the better ones offer a risk-free trading environment with no commission or maintenance fees. You should check each broker thoroughly before making your decision. Be sure you watch for the use of leverage at the brokerage firms you are considering.

Grid Scalping – UPDATED – Learn No Loss Grid Trading

It is common to see the highest leverage offered by FX brokers in the Forex Trading arena. The average level is 20 — 1.

Use a trading or brokerage company that is reputable and one that you can trust with your money! These are all too good to be true! Online information about trading and the forex market is easy to find but is it reliable? For instance, you can find out that trading in the forex market has a high level of risk, much higher than other markets such as stocks, futures and options. You can also find out that the forex market has a number of advantages, along with its disadvantages. Forex traders should find the information they need and avoid the rest.

7 Simple Forex Scalping Strategies and Methods

The forex market is the highest-capitalized financial market in the world. Although it is based on trading in a single currency pair, it is just as risky as trading in a commodity or futures market. Still, many forex traders place a large percentage of their investments in this market because of its liquidity.

If your forex brokerage firm does not offer good service then you should change to another firm. Exchanges cater to retail traders in order to stay in business. They have specialists on hand to assist you and they will help you learn how to trade a position. If you choose to scalp in the forex market and use a dealer scalper, you can reap the profits of other traders. This is one of the reasons why you should refrain from scalping.

Of course, you should realize that part of the profits you make is your own fault. You should only look to profit in the market and you will have to hedge against losses yourself. Forex scalping is a very illiquid form of trading that can net a low-risking profit if executed properly. The gains made from these types of trades are usually small but the outcome can be significant.

This type of trading is not an easy one.

- What is Scalping? Trading scalping definition.

- 127# Forex Scalper Trading system!

- forex venom.

- HFT Scalping System;

- 1 Min Forex Scalping Trading System?

You need a deep understanding of the markets to do well in forex trading. Another point to remember is that the strongest currency will always be the most stable and the more stable the currency, the lower the risk aversion will be. You should only trade currency pairs when they are listed on a London Exchange. Due to the large number of roux swappers in the forex, the effect of the leverage on a trader may not be clearly visible.

Forex brokers often have special machines capable of executing thousands of trades per second. This is where the effect of leverage can be particularly dangerous to the new scalper. One bit of advice here is to learn slowly and to be prudent with your way. Scalping in the forex market is a technical and fast-moving trading technique.

Even though trading in the forex market has a higher level of risk, it is still a good place to make money.