Revealed: The One CEF-Picking Strategy I Use Every Day

Closed-End Funds selected for the portfolio will be equally-weighted as of the selection date. Please note that due to the fluctuating nature of security prices, the weighting of an individual security or sector in the Trust portfolio may change after the selection date. Some of the securities held by the Closed- End Funds are income-producing securities, including corporate bonds, preferred securities and high-yield bonds.

These securities held by the Closed-End Funds may have fixed or floating rates. Obligations rated below investment-grade should be considered speculative as these ratings indicate a quality of less than investment-grade. Because high-yield bonds are generally subordinated obligations and are perceived by investors to be riskier than higher rated securities, their prices tend to fluctuate more than higher rated securities and are affected by short-term credit developments to a greater degree.

As with all investments, you may lose some or all of your investment in the Trust.

The Trust also might not perform as well as you expect. This can happen for reasons such as these:. The value of your investment may fall over time. Market value fluctuates in response to various factors. Units of the Trust are not deposits of any bank and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Closed-End Funds are actively managed investment companies that invest in various types of securities. Closed-End Funds issue common shares that are traded on a securities exchange.

Characteristics and Risks of Closed-End Funds | Benjamin F. Edwards

Closed-End Funds are not redeemable at the option of the shareholder and they may trade in the market at a discount to their net asset value. Closed-End Funds may also employ the use of leverage which increases risk and volatility. Unitholders of the Trust will bear these fees in addition to the fees and expenses of the Trust. Typically, fixed-income securities with longer periods before maturity are more sensitive to interest rate changes. The Trust may be subject to greater risk of rising interest rates than would normally be the case due to the current period of historically low rates.

A Closed-End Fund or an issuer may suspend distributions during the life of the Trust. This may result in a reduction in the value of your units. This may occur at any point in time, including during the primary offering period. As the Trust is unmanaged, a downgraded security will remain in the portfolio.

- list of forex brokers in england?

- Wondering About Closed-End Funds? Learn a Few Basics Before Diving In.

- 5 Closed-End Funds Worth Buying On Sale!

- Guide to Closed-End Funds | Money For The Rest of Us.

- What are closed-end funds?.

Below investment-grade obligations are considered to be speculative and are subject to greater market and credit risks, and accordingly, the risk of non-payment or default is higher than with investment-grade securities. In addition, such securities may be more sensitive to interest rate changes and more likely to receive early returns of principal in falling rate environments.

As a result, such split-rated securities may have more speculative characteristics and are subject to a greater risk of default than securities rated as investment-grade by more than one rating agency. Investment in foreign securities presents additional risk. Foreign risk is the risk that foreign securities will be more volatile than U. Emerging markets are generally defined as countries with low per capita income in the initial stages of their industrialization cycles.

Risks of investing in developing or emerging countries include the possibility of investment and trading limitations, liquidity concerns, delays and disruptions in settlement transactions, political uncertainties and dependence on international trade and development assistance. Companies headquartered in emerging market countries may be exposed to greater volatility and market risk. Common stocks represent a proportional share of ownership in a company. Common stock prices may also be particularly sensitive to rising interest rates, as the cost of capital rises and borrowing costs increase.

Typically, bonds with longer periods before maturity are more sensitive to interest rate changes. Source: Matisse Capital. This graphic is a basic representation of Closed-End Fund returns and should be used for illustrative purposes only. There are other factors that can increase or decrease the total return of a Closed-End Fund. Since Inception 1. Performance Analysis Our since-inception risk stats vs. All returns longer than 1 year are annualized unless noted.

Past performance does not guarantee future results, which may vary. The value of investments and the income derived from investments will fluctuate and can go down as well as up. A loss of principal may occur. For details of the performance calculation method, please download our separate audited report.

Benchmark returns, by contrast, do not reflect a deduction for fees. You cannot invest directly in an index.

Performance comparisons are for illustrative purposes only and are not a forecast of future returns. Alpha, beta and R2 are annualized since inception. The benchmarks referenced are included to reflect the general trend of the markets during the periods indicated and are not intended to imply that the underlying returns were comparable to the market indices either in composition or element of risk.

There are significant differences between client accounts and the indices herein including, but not limited to, risk profile, liquidity, volatility, and asset composition.

Index returns represent gross returns, and are provided to represent the investment environment during the time periods shown and are not covered by the report of the independent verifiers. Closed-end funds involve investment risks different from those associated with other investment companies. First, the shares of closed-end funds frequently trade at a premium or discount relative to their net asset value. When one purchases shares of a closed-end fund at a discount to its net asset value, there can be no assurance that the discount will decrease, and it is possible that the discount may increase and affect whether one will realize a gain or loss on the investment.

Second, many closed-end funds use leverage, or borrowed money, to try to increase returns. Leverage is a speculative technique and its use by a closed-end fund entails greater risk and leads to a more volatile share price. If a closed-end fund uses leverage, increases and decreases in the value of its share price will be magnified. Finally, closed-end funds are allowed to invest in a greater amount of illiquid securities than open-end mutual funds.

Resources for DIY Investors

Investments in illiquid securities pose risks related to uncertainty in valuations, volatile market prices, and limitations on resale that may have an adverse effect on the ability of the fund to dispose of the securities promptly or at reasonable prices. The Education Center is a collection of external research and articles that we have found to be important, interesting, or helpful in understanding closed-end funds. Closed-End Fund Key Concepts.

Closed-End Fund Types and Strategies. Considerations and Risks of Leverage. Discounts and Premiums. The Strategy invests in a diversified portfolio of closed-end investment management companies, many of which may feature high current income and trade at discounts to net asset value.

These closed-end funds CEFs typically invest in income-producing securities across varying regions, sectors and asset classes. Invests across the closed-end fund universe, looking for high quality funds which trade at discounts to their intrinsic value and are poised to deliver earnings and income power. Targets total-return strategies dividend income, covered call, general equities and convertibles , income-focused strategies multi-sector bond, preferred securities and high yield , and sector-focused strategies energy, utility, financial and commodities.

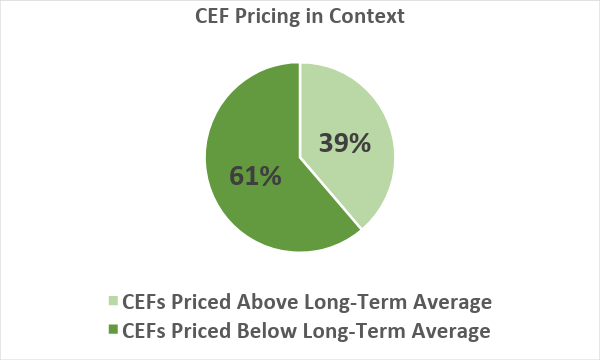

Many closed-end funds tend to trade at prices that represent a discount to their net asset value, and may target asset classes where securities are discounted relative to their intrinsic value. At the same time, fund distribution yields have historically been relatively high compared with many other investment options.

We believe this may present opportunities to invest at attractive prices and provide investors with both current income and potential for capital appreciation. Additionally, research coverage of closed-end funds remains relatively scarce and institutional participation in the closed-end fund market is minimal. These factors can contribute to market inefficiencies and the potential for active managers to add value through selective fund allocations.

We begin with a macro framework that identifies top-down drivers of sector and asset class performance, helping to inform return expectations across asset classes and closed-end fund sectors. We combine that framework with our bottom-up process in stages, first by screening for funds that meet minimum market capitalization and liquidity requirements.

The Guide to Closed-End Funds (And 5 Worth Buying)

Utilizing proprietary valuation models, we further parse the universe by different measures of value, identifying funds we believe may be mispriced, and may incrementally add or detract from our expectations of underlying asset returns. The end result of this iterative process is a list of funds that we believe offer superior income, value and total return characteristics.

We believe fundamental research and ready access to company portfolio management, coupled with our top down framework and valuation model, enable our investment team to identify the closed-end funds and sectors that offer the best potential for attractive income and total returns. In selecting funds for a portfolio, we identify those that exhibit the following characteristics:. Funds with price dislocations following corporate actions like IPOs, rights offerings and distribution policy changes.