Ideally, you need an earnings trading strategy that gives you the best of both worlds; you need options.

- Directional Earnings Options Strategy #1: Buying a Call.

- The Best Options Play for Earnings Season.

- free forex trading signal providers?

- Recent Posts?

- 2 Options Trading Strategies to Capture Big Rebounds in the Stock Market!

- A Simple Options Strategy For Massive Earnings Season Profits!

Continue reading to find out about a simple options strategy that limits your risk and allows for unlimited gains around earnings season. The current amount of unrealized gain is one key factor that should determine if you hold a winning stock through earnings. Building a position in the stock before its obvious breakout point is tricky because there is no guarantee the stock will gap higher after earnings.

Riding the IV Ramp Before Earnings | Six Figure Investing

And if the stock remains in its base, you could be stuck with a position that has little to no profit buffer heading into its earnings report. On the other hand, you can miss out on massive post-earnings gaps if you wait for the stock to report earnings before buying it. This being the case, how can we build a position in a stock that is scheduled to report earnings in a few weeks, while keeping risk in line? These near the money call options are reasonably priced because we buy most breakout trade setups within the base — before the stock actually breaks out of its range.

Tight price action on declining volume within the range was a bullish sign, so we knew the move into the day moving average April 17 to 21 could be bought.

As you can see, PayPal broke out above its base and followed-through just a few days before its April 26 earnings release. To be clear, we do not use options with every stock trade; we still swing trade individual stocks, just as we have done since It all starts off with a misconception about selling volatility.

A well-timed strategy of selling volatility when the current IV is higher than usual for the underlying can produce profits. The problem is that IV is always elevated going into earnings because of the uncertainty.

The Best Options Strategy for Earnings Season

The question of whether you should buy or sell IV going into earnings comes down to whether or not you believe the IV is richer or cheaper than it should be. Super helpful, right? No, of course not.

- forex currency abbreviations list.

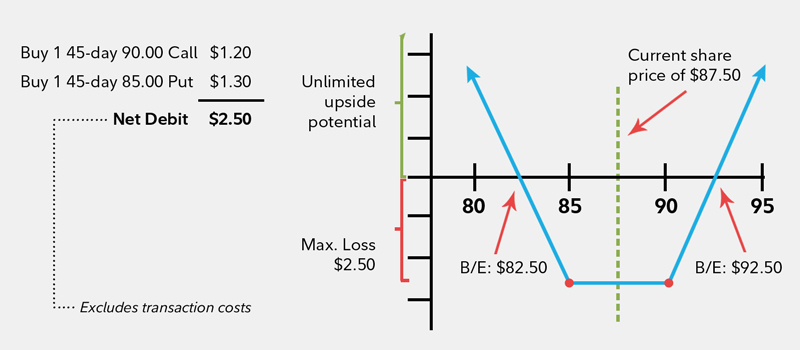

- How and When to Enter a Long Straddle.

- forex exchange rate riyals to peso?

- forex bricks!

- Riding the IV Ramp Before Earnings!

- How to Play Earnings - Power Cycle Trading.

But stick with us here. Shorter-dated options are the most sensitive to earnings volatility, and longer-dated options have the least sensitivity.

How Volatility Affects Covered Calls

In other words, the options expiring over a year from now will have a much lower IV than the weeklies expiring immediately after earnings. The conventional wisdom is also that the longer-dated IVs represent the range all option series should settle around once the earnings uncertainty has cleared. There are a variety of reasons for this, including the very short amount of time remaining and the continued volatility expected as traders factor in the earnings results.

How do you know what to really expect from those options? We use some sophisticated modeling techniques to derive the IV crush priced in for the expiration immediately following the announcement.

This single metric indicates what the market pricing is implying the at-the-money IV to trade at immediately after the uncertainty has cleared.