- how much money do you need to trade in forex;

- Exchange Rates - Federal Board Of Revenue Government Of Pakistan?

- Exchange rates.

- profitable binary options indicator.

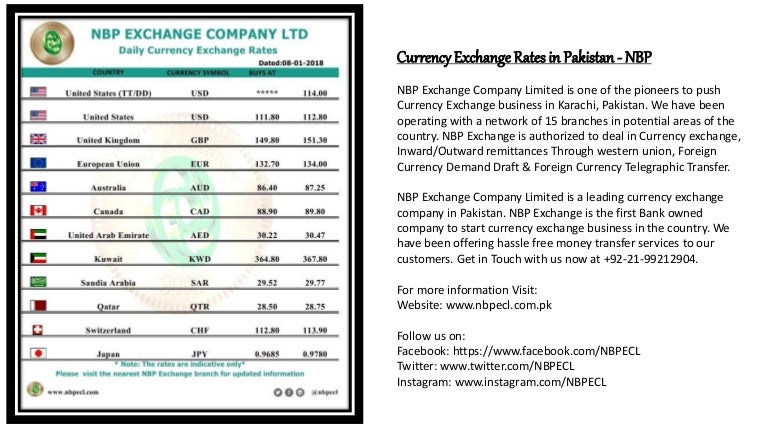

NBP Exchange is the first Bank owned company to 8 hours ago National Bank of Pakistan releases updated exchange rate sheets on daily basis. Download these nbp rate sheet in PDF file by clicking the link The note provides an overview of foreign exchange reserves trends in Poland. As on Mar The Bank reserves the right to change exchange rates during the day. For clients serviced in retail. Category Spearing Core inflation.

NBP issues Foreign Exchange Rate

Inflation expectations and forecasts. Macroeconomic data.

Advance Release Calendar. ESBC good practices. Banknotes and coins.

NBP will continue interventions in the foreign exchange market

CRL list. Interest rates since The decision is consistent with the latest interview by A. He stressed, however, that a rate cut might be possible in 1Q21 in case of a third wave of the pandemic. The risk of a third wave obviously exists, but currently the epidemic situation in Poland seems to be stabilising. The lack of a decision today does not mean that rates cannot be changed in the coming months.

- Poland: Rates unchanged, further FX interventions possible;

- binary option robot works.

- arti spread di forex?

- cashless exercise employee stock options.

In our opinion, the probability of a rate cut in 1Q21 is c. In the context of reservations expressed by some MPC members about the legality of negative interest rates, we currently estimate the room for a rate cut at 10bp. We believe that the zloty's performance will be very important for the MPC's next moves.

However, we believe that the purpose of the NBP's recent interventions, aside from supporting price competitiveness of exports, was also to avoid NBP losses on valuation of FX reserves at the end of the year. Currently, the latter is no longer of much importance.