This weight is placed to remove some of the lag found with a traditional SMA. This makes the EMA a perfect candidate for trend trading. Before entering into a trend-based position, traders need confirm the trend. This analysis can be confirmed by the use of a EMA as marked on the chart.

Traditionally traders are bullish when price is above the EMA and bearish if price resides under the average. Below includes a 12 and 26 period EMA have been added to the graph. Since traders are looking to buy in an uptrend, it is important to identify areas where momentum is turning back in the direction of the trend. At this point traders can look to buy the market. Remember, this process can be replicated for a downtrend by selling in the event that the 12 period EMA crosses below the Now that a trade has been opened, traders need to identify when it is time to exit the market.

This is the third and final step in developing a successful strategy. Trader buy on a return to bullish momentum therefore, traders should close positions when momentum subsides. This can be found in an uptrend when price moves back and touches the 12 period EMA. Stops should also be placed when trading with the trend. One simple methodology is to place stops under a swing high or low on the graph. This way if the trend turns, any positions can be exited for a loss as quickly as possible. The chart below exhibits this technique using a portion of the trade example above.

This provides a complete trade process for traders looking for a simple trend trading system. The EMA is often seen as complex in nature however, the above article shows how simple and effective this indicator can be for both novice and experienced traders alike. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances.

Forex trading involves risk. Losses can exceed deposits. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. The expiration period of the option is 5 minutes — next 5 candles on the M1 chart.

What is EMA trading?

The moving averages are pointing downwards When on the 1-minute chart M1 faster blue moving average EMA8 crosses the red moving average EMA20 , we open PUT The expiration period of the option is 5 minutes — next 5 candles on the M1 chart. Try trading on binary options on currencies, indices, commodities and shares of popular companies.

If you lose, regardless of the size of the loss, you never lose more than you bet. You can also choose other expiration hours for options, both shorter and longer.

Friday, April 2, Leave us a comment! You need to improve the trading plans. Are you a beginner in trading? Read this… Brokers. How to trade news on the Forex market Analysis. Pullbacks are also commonly known as retracements. In a downtrend, these lower highs are the pullbacks.

ema charts for trading decisions - Baval

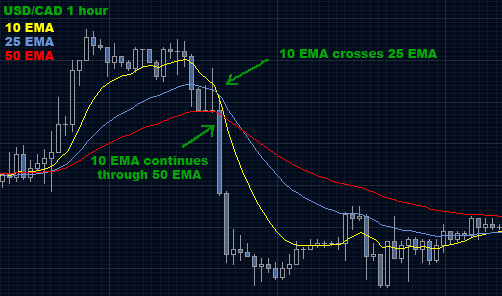

So how do you trade pullbacks? Hence EMAs would be better for our trading strategy. However, there are more times where the market ignores the EMAs and just goes through them.

So how do we know when the market will bounce off the EMAs? Unfortunately, that is a trick question. We will never know when the market will bounce off the EMAs. So first of all, we want to wait for a crossover of the EMAs. But the second time it touched the 50 EMA, it bounced off. That will be considered the 1st bounce. From there, we will be looking for the 2nd bounce to get into a Long trade. So we need to have a trade entry criteria to go Long. A bullish candlestick pattern forming.

A close above the bullish candlestick pattern. Immediately after the EMA crossover, we have identified our 1st bounce. Now that we have identified our 1st bounce, we now wait for a 2nd bounce. This is a hidden divergence. The next step is to wait for a bullish candlestick to form.

#2: Moving Average Day Trading Setups

In the chart above, a Bullish Piercing Candlestick Pattern formed on the 2nd bounce. Our Take Profit level will be at 1. A bearish candlestick pattern forming. A close below the bullish candlestick pattern. Once this happens, we will be looking for our 1st bounce.

It went above the EMAs, came back down, went back up again, then came back down again.

EMA 8/20 – 5 minute Strategy for Options

We do not consider this a bounce. So at this point, we still want to look for our 1st bounce. Several bars later, we have our 1st bounce. After the 1st bounce, the market very quickly dropped down in one big candlestick bar. And then it went back up again to the 50 EMA. However, the next few bars saw the market somewhat consolidating and not really making any move. Finally, the market went lower and it closed below the low of the Bearish Pin Bar.

That is our trigger to go Short at the close of that bar. Then we place our Stop Loss above the high of the previous swing high.

As for the Take Profit level, again either we place it at 1. The answer is because we have placed our Stop Loss pretty far away at the previous swing high. That means our Stop Loss distance is pretty wide. Ultimately, it all comes down to your trading style and psychology.