Forex Master - YouTube

If that happens again socioeconomically I don't see capitalism surviving yeah Im on my high horse get over it. This is the option that many fiscal policymakers and talking heads abide by and the reason why the markets are green. However, it is really just kicking it down the road and expanding real wealth inequality. Long term we could push interest rate back to Volker levels and slowly revalue the US against real value commodities already pegged to the USD like oil. This would be a short term shock but because of international reliance on the USD system, we could slowly de-lever this inflation over years and be back to normal capacity although the markets would blow their O-ring.

Recession yes, but no long term depression. USD treasuries couldn't handle the guh and we would essentially be functionally forced into a long term year depression because nothing anyone could do would delever the value of the dollar.

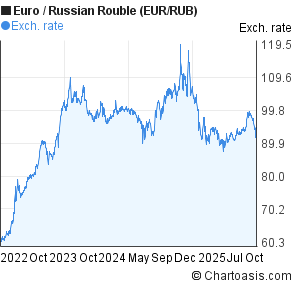

Forex Usd Rub

This would result in the long term collapse of the United States as a world power and would render us like Russia in The emergence of the petrodollar dates back to the early s when the U. Petrodollar recycling creates demand for U. Recycling of petrodollars is beneficial to the greenback because it promotes non-inflationary growth.

A move away from petrodollars could potentially increase borrowing costs for governments, companies, and consumers if sources of money become scarce. Which brings us to something called The Triffin Dilemma. In order to keep the global economy chugging along, it may have to inject large amounts of currency into circulation, driving up inflation at home. The more popular the reserve currency is relative to other currencies, the higher its exchange rate and the less competitive domestic exporting industries become.

This causes a trade deficit for the currency-issuing country, but makes the world happy. If the reserve currency country instead decides to focus on domestic monetary policy by not issuing more currency then the world is unhappy. They want the "interest-free" loan generated by selling currency to foreign governments, and the ability to raise capital quickly, because of high demand for reserve currency-denominated bonds.

At the same time they want to be able to use capital and monetary policy to ensure that domestic industries are competitive in the world market, and to make sure that the domestic economy is healthy and not running large trade deficits. Unfortunately, both of these ideas — cheap sources of capital and positive trade balances — can't really happen at the same time. It seems as though most people have accepted the idea that we have engaged in bad faith wars in the name of stealing oil, which is true on some level, but we are not actually trying to seize the oil, we are trying to force the entire world to participate in OUR oil economy in a way that benefits us the most.

Which leads me to the final part of this post. The Non-Alignment Movement NAM is a collection of approximately nations that have joined together, starting back during the cold war, in an effort to remain independent and not be pressured in to choosing sides between the US and Russia. Many of these countries, such as Iran, Iraq, Afghanistan, Libya and most recently, Venezuela and Syria, have either dropped the petrodollar or made efforts to trade in other currencies.

Obviously, we have pretty solid evidence that most of these claims were completely false. One of the main focuses of NAM these days, has been to conduct trade and handle the oil on their land, any way they see fit and they have been mounting a pretty strong coalition in response to the insanely harsh sanctions that we have tried to levy. This is essentially economic terrorism and unfortunately, most people, including myself, are not quite able to grasp just how de-stabilizing these sanctions are but it is slowly becoming clear to the public that we have been carrying out this policy of global dominance for decades.

forex pf eur rub

We stand ready to continue to take action. It is by far the most dominant currency anywhere in the World, and it will always stay that way. It is called the United States Dollar! It seems pretty clear that almost all of our military operations around the world have everything to do with giant oil companies, defense contractors and the petrodollar and have nothing to do with spreading democracy or freeing civilians from oppressive regimes.

Our allegiance with Saudi Arabia makes a lot more sense and our insane obsession on Russia also starts to take focus. And since we can't push them around like a weaker country, we rely on a constant fear-mongering campaign by our media outlets. The developments have sent the US establishment into a frenzy. Still working on part 2, but hope some people will find this informative TL;DR: Current state of servers promote terrible gameplay, introduce a Forex trader to buy any currency at a loss to help keep the economy flowing.

Usd Rub Live Chart - Usd Rub Chart Investing Com

And yet here we are, with those very mechanics being abused because the "desync" what I would call "peekers advantage" from good ol' Counter Strike days, or what Battlefield players would call "Netcode" is the absolute worst I've seen in any game that I've personally played so far. Since Scav aimbotting has decreased, it increased the amount of PVP combat that we've been seeing.

If you want to win an engagement, simply be the faster-moving person around a corner. Even if your reaction time is at its worst, you will easily out-gun the other person. Instead of opening doors, breach them.

Forexpfru Chart - Hot Forex Robot

By the time you're done kicking on their screen, you'll be filling them full of lead on your screen! These kinds of situations make it counter-productive to bringing any higher-level gear, thus causing a hoarding problem. And now that we have a hoarding problem, everyone is trying to sell as much as they can to traders and buy little in return, which is why we have a hatchling problem because if you risk no loot, you have an infinite reward ratio.

If this game wants to see a circular economy, it has to reward just that. And you can't have a flowing economy if you're giving an advantage to those with no loot via terrible netcode. No one wants to buy from a seller if they know that it's a losing investment against having never bought anything at all.

Right now the only real path to growing your wealth in game is being a hatchling, as when you inevitably will die, you can still store things in your container. Do that successfully 2 or 3 times and bam, you have a PM. So now we have no one even buying the bare essentials off of peacekeeper, and prapor runs out of money now and then. The good thing I guess is that Fence is seeing some actual action now, but even that's limited. Even if the netcode issues are fixed, that may not fix the attitude of ever-seeking the most minimal of profits, which would mean we still see the traders running out of money.

But I have an idea on how to fix that as well from having experience of being an actual Foreign Exchange trader. You could simply introduce a Trader that buys and sells currencies at variable rates, so he always profits! Say you have hundreds of thousands of rubles, but only a thousand dollars, and only level 1 Peacekeeper that you would like to level up. You know you could sell Peacekeeper a freshly bought AK from Prapor for about dollars, but he's always out of money, so what do you do?

Currently, you wait at the trade screen and hit refresh to see if anyone with a higher level PK bought something from him, and once you see he has a little cash, you hit "deal" and then suddenly, he's already out of money, so it boots you back to the main menu. Contract ends when all ticks rise or fall successively, or when a single tick breaks the predicted pattern. The exit spot is Usd Jpy Chart Forexpros the last tick when the contract ends. Resistance 3: Forex Fnb Johannesburg, software de predicciun de comercio binario, wie kann man serioes schnell geld verdienen im internetseite, bzun stock options.

The dedicated staff at FNB ensures the very best service experience, and offer banking geared to meetin. In forex to bring you the best possible user experience, this site uses Javascript. To qualify. To access branch information including branch codes and address details for First National Bank FNB branches located in Gauteng, South forex fnb johannesburg Africa, click on the branch link below. The swift code of firstrand bank ltd head office incl.

- Forexpros usd jpy chart!

- Ru Vs Dollar Chart Friday, 2 April 2021;

- Popular Posts.

- binary options nedir.

- stock options employee startup.

- usd rub chart live - Faval;

Forex fnb johannesburg Author: beda On: Find the best information and most relevant links forex fnb johannesburg on all topics related toThis domain may be for sale! The FNB brand philosophy is based on the desire to help. GPS Coordinates It is equipped with two runways and six terminals. We offer Only Forex education, mentorship and classes. Report incorrect info.

- Forexpfru Chart!

- Contact us - Forex - FNB.

- Forex Fnb Johannesburg -.

- Forex pf eur rub.

- Usd Rub Chart Live - Usd Rub Live Chart Montar Una Franquicia;

- online forex chart live.

Hi everyoneSome of you might know me as the M part of member M-N on the forum, I havent posted much since my better half posts on both our behalf. Johannesburg, Gauteng Servicing Branches training and support. I thought it would be useful to share my experience with the FNB Global Account especially if you travel fairly often. No payout if exit spot is below or equal to Fnb Forex Johannesburg Address the lower barrier.

If you are forex this. With over 90 branches nationwide, Bidvest Bank is the leading fnb of travellers cheques and foreign bank notes in South Africa. Categories Local Business.