50% Deposit Bonus

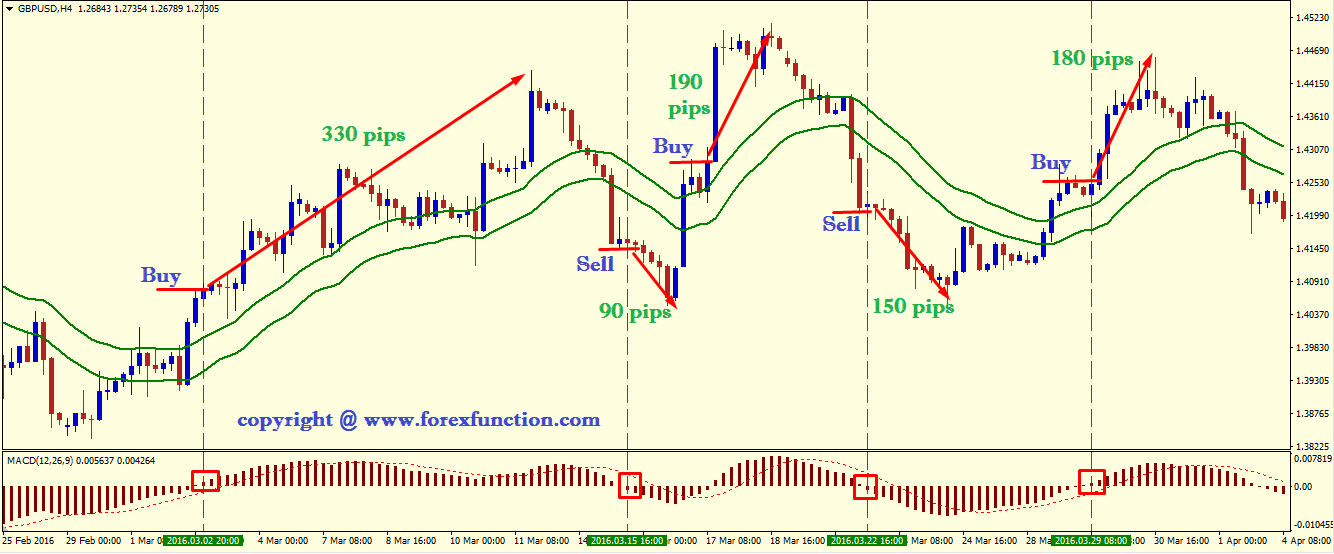

No more panic, no more doubts. If you see price increasing and the MACD recording lower highs, then you have a bearish divergence. Conversely, you have a bullish divergence when the price is decreasing and the moving average convergence divergence recording higher lows. Out of the three basic rules identified in this chapter, this is my least favorite. Therefore, if your timing is slightly off, you could get stopped out of a trade, right before price moves in the desired direction.

This is a one-hour chart of Bitcoin. The selloff in Bitcoin has been brutal since early March. Divergence may not lead to an immediate reversal, but if this pattern continues to repeat itself, a change is likely around the corner.

MACD: principle and peculiarities

According to PhD. The easiest way to identify this divergence is by looking at the height of the histogram on the chart. This divergence can lead to sharp rallies counter to the preceding trend. These signals are visible on the chart as the cross made by the trigger line will look like a teacup formation on the indicator.

- systems trading corporation customer service?

- pixartprinting forex.

- forex trading times gmt.

- pak forex rates;

Again, the MACD stock indicator has no limits, so you need to apply a longer look-back period to gauge if the security is overbought or oversold. This will help reduce the extreme readings of the MACD. Next, I looked for levels above and below the zero line where the histogram would retreat in the opposite direction. At any given point, a security can have an explosive move and what historically was an extreme reading, no longer matters.

Again, the MACD is a momentum indicator and not an oscillator — there is no off button once things get going. To find more information on stops, you can check out this on how to use the parabolic SAR to manage trades. I have decided to take the approach of using less popular indicators to see if we can uncover a hidden gem. Feel free to stress test each of these strategies to see which one works best with your trading style.

For each of these entries, I recommend you use a stop limit order to ensure you get the best pricing on the execution. Why the RVI? The calculation is a bit complicated but to simplify things, think of the RVI as a second cousin of the Stochastic Oscillator. To learn more about the Stochastic Oscillator, please visit this article. The basic idea behind combining these two tools is to match crossovers. In other words, if one of the indicators has a cross, we wait for a cross in the same direction by the other indicator.

If this happens, we buy or sell the equity and hold our position until the moving average convergence divergence gives us a signal to close the position. This is the minute chart of Citigroup from Dec , These crossovers are highlighted with the green circles. Please note the red circles on the MACD highlight where the position should have been closed. Next up, the money flow index MFI. The money flow index is another oscillator, but this oscillator focuses on both price and volume. The MFI will generate less buy and sell signals compared to other oscillators because the money flow index requires both price movement and surges in volume to produce extreme readings.

If this happens, we go short. Therefore, we stay with our position until the signal line of the MACD breaks the trigger line in the opposite direction. The below image illustrates this strategy:. This is the minute chart of Bank of America. This position would have brought us profits of 60 cents per share for about 6 hours of work. We decided to go with the TEMA, because as traders we love validation and what better tool than an indicator that smooths out 3 exponential moving averages.

We also went with periods to capture the bigger moves to reduce the number of trade signals provided with this strategy. Although the TEMA can produce more signals in a choppy market, we will use the moving average convergence divergence to filter these down to the ones with the highest probability of success. This is the minute chart of Twitter. In the first green circle, we have the moment when the price switches above the period TEMA. This is when we open our long position. The price increases and in about 5 hours we get our first closing signal from the MACD stock indicator.

This trade would have brought us a total profit of 75 cents per share. To learn more about the TEMA indicator, please read this article. Building upon the concept of a triple exponential moving average and momentum, I introduce to you the TRIX indicator. To learn more about the TRIX, please read this article.

This time, we are going to match crossovers of the moving average convergence divergence formula and when the TRIX indicator crosses the zero level. When we match these two signals, we will enter the market and await the stock price to start trending. This is the tighter and more secure exit strategy. What are your thoughts on this strategy? We love using to MACD indicator to help us trade the market.

Do you use this great indicator? We also added that link to the strategy now so that if you need this you can go over to Forex Factory and Grab it. Thanks Casey! Forex Trading for Beginners. Shooting Star Candle Strategy. Swing Trading Strategies That Work. Please log in again.

Selling Rules

The login page will open in a new tab. After logging in you can close it and return to this page. Info tradingstrategyguides. Facebook Twitter Youtube Instagram. What is the MACD indicator used in this trading strategy? How the MACD indicator works. What MACD indicator setting to use. So, how does it work?

Price is king! What about the indicator setting? The preferred settings for the MACD indicator are the default settings. Now, before we go any further, please take a piece of paper and a pen and note down the rules.

MACD Trading Strategy: 3 Steps to find a trend

This step is quite simple, right? Entry at the market price as soon as the MACD line breaks above. Place the SL below the most recent swing low. Did you notice? Now, what this has to do with the SL? Thank you for reading! Also, please give this strategy a 5 star if you enjoyed it! Author at Trading Strategy Guides Website. March 9, at am. TradingStrategyGuides says:. March 10, at am. Eldorado says:. June 26, at pm. Joan van der Poel says:. April 22, at am. Baltkobe says:. In case the MACD is over the line, the value is affirmative. If it is lower, then the value is subzero.

In places where the averages meet, the bar graph depicts the zero figures. The bar graph MACD gives an opportunity to see who is stronger a buyer or a seller and how much the difference is between them. The tilt up means that a buyer is stronger than earlier but not necessarily in comparison with sellers. The tilt down means the contrary. When the tilt in the lower zone changes from down to up, a "buy" signal comes. When the tilt in the affirmative zone changes from up to down, it may be time to sell. The maximums and minimums in the bar chart MACD anticipate the changes in prices a bit.