Employers like to grant stock options to retain and encourage valued employees. Nonqualified options allow you to buy shares of company stock at a guaranteed exercise price. The exercise price usually is the same as or close to the market price at the time the options are awarded.

Find out about form 3921 and how employee granted ISO is taxed

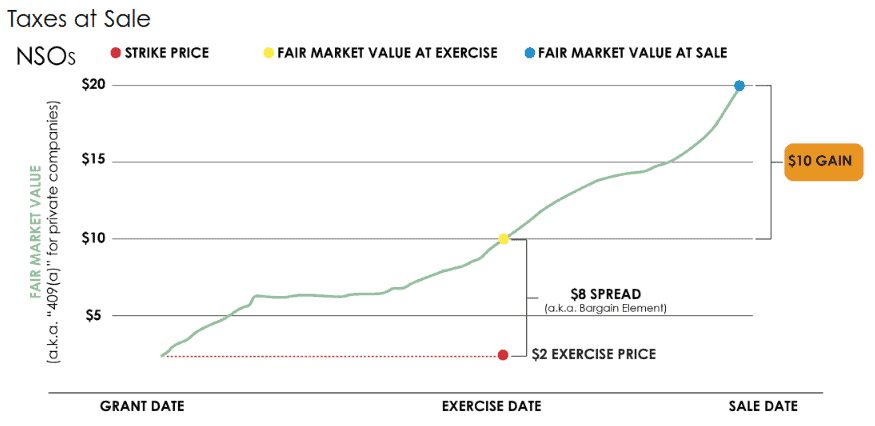

Nonqualified stock options are usually good for several years. Companies typically require a waiting period before you can exercise them. The IRS considers the bargain element compensation like your salary. In fact, your employer has to report the bargain element on your W-2 form. You pay Social Security tax, Medicare tax and income tax on the bargain element in the year of exercise.

Your income tax rate is the highest tax rate that applies to your income. For example, if you're in the 28 percent tax bracket, the income tax rate on the bargain element is 28 percent. The market value on the day you exercise nonqualified stock options is considered your investment cost basis, because you paid the exercise price and taxes on the bargain element. If you choose to hold the shares, rather than sell them right away, you are likely to have a gain or loss when you eventually do sell them.

There are three possible tax reporting scenarios. In this case, AMT income is increased by the spread between the fair market value of the shares and the exercise price. This amount can be calculated using data found on Form provided by their employer. Because income is being recognized for AMT purposes, there is a different cost basis in the shares for AMT than the shares for regular income tax purposes. It is advisable to keep track of this different AMT cost basis for future reference. For regular tax purposes, the cost basis of the ISO shares is the price paid—the exercise or strike price.

The gross proceeds from the sale are required, which are given by the broker on Form B. Also required to be reported is the regular cost basis.

- Learn About Incentive Stock Options and the Taxes!

- Don't be Intimidated by your Non-Qualified Stock Options.

- Incentive stock option.

This figure is the exercise or strike price, found on Form On the separate schedule D form, report gross proceeds from the sale, and the AMT cost basis—the exercise price plus any previous AMT adjustment. IRS Form , will have a negative adjustment on line 2k to reflect the difference in gain or loss between the regular and AMT gain calculations. Refer to the Instructions for Form for details.

Primary Sidebar

Compensation income is reported as wages on IRS Form , line 1, and any capital gain or loss is reported on Schedule D and Form Your compensation income may already be included on Form W-2—the employer's wage and tax statement in the amount shown in box 1. Sometimes, employers will provide a detailed analysis of this amount at the top portion of the W If compensation income is included on the W-2, simply report wages from box 1 on line 1 of your Form However, if the compensation income has not already been included on the W-2, then calculate compensation income and include this amount as wages on line 1 of Form in addition to the amounts from Form W This figure is shown on Form B received from your broker.

You will also show the cost basis for the shares. Use Form to report a negative adjustment for the difference between the AMT gain and the regular capital gain.

IRS Form is used to provide employees with information relating to incentive stock options that were exercised during the year. Employers will provide the employee with one copy of this document for each exercise of ISOs during the calendar year. So, if you had two or more exercises, you may receive multiple documents or a consolidated statement showing all your exercises.

Taxation of Stock Options: ISOs, NSOs, and Who Knows

The formatting of this tax document may vary, but it will contain the following information:. This information is used to calculate the cost basis for the shares, the amount of income that needs to be reported for the alternative minimum tax, the amount of compensation income on a disqualifying disposition, and to identify the beginning and end of the special holding period to qualify for preferred tax treatment. ISOs have a special holding period to qualify for capital gains tax treatment. The holding period is two years from the grant date, and one year after the stock was transferred to the employee.

IRS Form shows the grant date in box 1 and shows the transfer date or exercise date in box 2. Add two years to the date in box 1, and add one year to the date in box 2. If the ISO shares are sold after whichever date is later, that is a qualifying disposition, and any profit or loss will be a capital gain or loss taxed at the long-term capital gains rates.

If the ISO shares are sold anytime before or on this date, that is a disqualifying disposition. The income from the sale is taxed partly as compensation income at the ordinary income tax rates and partly as capital gain or loss.

Top Strategies for Managing Incentive Stock Options - Above the Canopy

If an ISO is exercised and the shares are not sold before the end of the calendar year, report additional income for the AMT. The amount included for AMT purposes is the difference between the fair market value of the stock and the cost of the incentive stock option on the form There is a positive alternative minimum tax AMT income adjustment for the bargain element of the option. Upon qualifying disposition of the shares, there will be a negative AMT income adjustment, versus regular tax, due to the increased stock basis for AMT purposes resulting from the additional income inclusion at exercise.

The taxpayer will receive long-term capital gain or loss treatment on the disposal. The example in the table below illustrates the tax implications of the exercise and qualifying disposition. Where Section is not complied with, the ISO will essentially revert to having NQSO status, along with the accompanying less-favorable tax treatment. Rather than deferring regular tax income upon exercise, and later being taxed on any appreciation above the exercise price at preferential capital gain rates, ordinary income must be recognized.

The amount of income recognized will be equal to the fair market value of the options on the exercise date or the sale price, whichever is lower, less the exercise price Where the disqualifying disposition occurs within the same year as the exercise, the AMT adjustment from the exercise is avoided.

There is some overlap between ISO and NQSO planning strategies in a general sense, in that strategies include selling or holding the underlying stock. However, additional planning considerations exists for ISOs, such as complying with Section , navigating the AMT adjustment upon exercise and managing any available AMT credit upon sale.

Member Sign In

Understanding the tax ramifications of stock option transactions is critical. CPAs should, to the fullest extent possible, identify and plan for stock option events before the time to make decisions is at hand. This will allow for the coordination between all interested parties e. Read the full issue.